Fincoaster Weekly - 21 February 2025

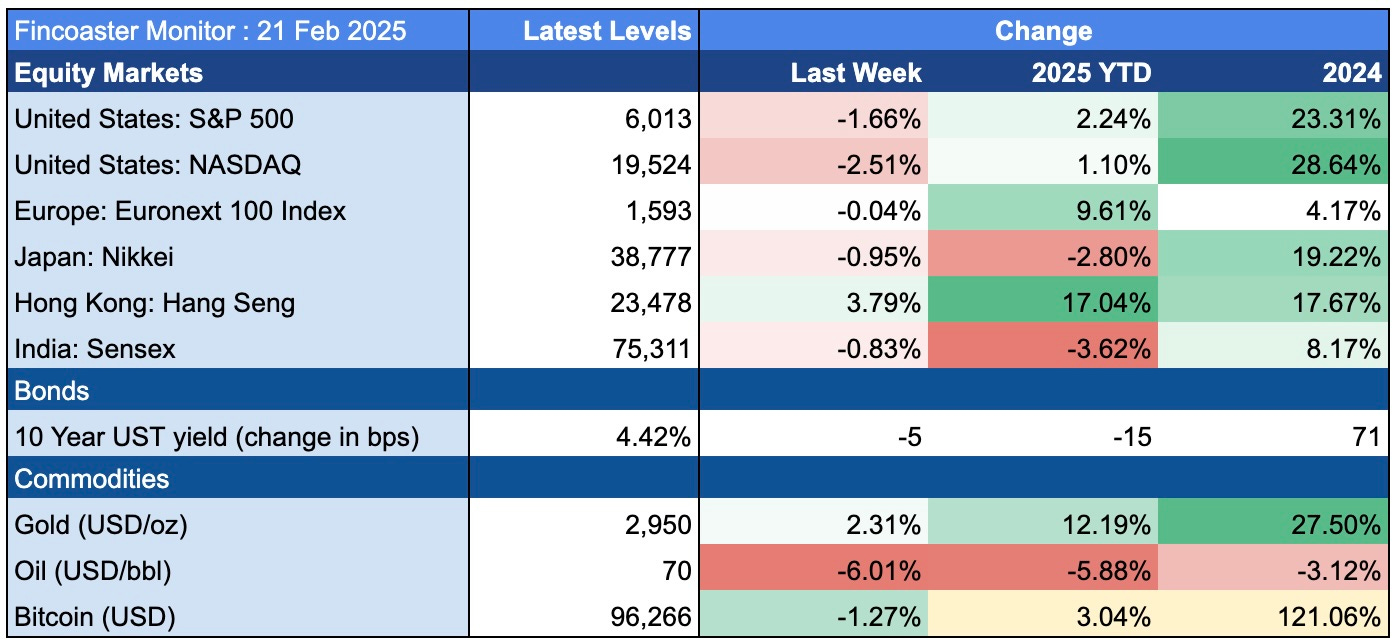

Economic worries weigh on US equities, Hong Kong markets rally strongly, and gold approaches US$3,000/oz

Happy Saturday,

Welcome to Fincoaster’s first weekly newsletter!

This is our weekly take on market events, including what took place this week and what to look forward to next week.

One important topic we examined this week was the significant impact fees can have on investment returns over the long run. Read about how even slight differences in fee levels can compound and how hedge fund investors paid away half of their returns in fees.

Below we look in to key market trends, what to look out for and some interesting charts.

The Week That Was

US stock markets were lower this week, with the S&P 500 down by -1.7% amid concerning economic data. This included a sharp decline in consumer confidence, a drop in home sales and a contraction in the service sector.

A cautious earnings report from Walmart and lingering tariff uncertainties added to the wary sentiment.

Declines in equity markets were positive for bond markets, with buyers pushing yields on the 10-year US government bond down by five bps (0.05 percentage points) to 4.42%. Read our post on climbing bond yields despite Fed rate cuts and potential opportunities.

Hong Kong stock markets continued to rally sharply this week and are currently up 17.0% this year. The buzz over DeepSeek, China's answer to ChatGPT, and strong results from Alibaba have attracted buyers into Hong Kong equity markets.

India continued to underperform, with the benchmark index down -3.6% this year. Foreign investors have been selling, and high valuations have been normalising.

Gold (+2.3%) continued its march towards US$3,000/oz. Read our post on how buying by global central banks underpins demand for the precious metal.

The varied performance of asset classes shows the importance of strategically planning one's asset allocation. Read our post on Your Financial Future Depends on the Right Asset Allocation.

What to look out for next week

US inflation data: On Friday, 28 February, we will get an update on the Fed's preferred inflation reading (US personal consumption expenditures (PCE) price index). This indicator could alter expectations of interest rate cuts.

Nvidia earnings will also be keenly watched amid questions about whether DeepSeek's AI model impacts chip demand.

Trade tariff details: President Trump warned of more tariffs last week, with more information to be announced later. Any major tariff announcements could negatively impact global markets.

Chart of the Week (1)

Last week, the Federal Reserve released minutes from its January meeting, during which interest rates were unchanged. The Fed was generally comfortable with the health of the US economy but wanted to see inflation decline further. Thus, it will likely keep rates on hold for at least the next few meetings.

Below is the Fed's 'dot plot' chart. Each dot represents one member's Fed Funds rate projection in the coming years. Market participants closely track the median projected rate for each year-end.

From the below, we can see that as of the latest dot plot, most Fed members expect interest rates to decline by 0.5 percentage points in 2025. This is read by comparing the median plot for 2025 (circled) to the current level, which is also marked on the chart.

Chart of the Week (2)

Bank of America's (BofA) February Global Fund Manager Survey (FMS) showed that global fund managers are almost fully invested, with cash levels down to 3.5%.

The low cash levels reflect fund manager confidence in the market.

However, low cash levels also imply investors are aggressively positioned. This may leave the market more vulnerable to de-risking trades should the market mood change.

Thank you for reading. Please share the newsletter with those whom may benefit.

Suvir Mukhi | Fincoaster.com

Disclaimer:

All content, information and opinions provided on Fincoaster are for informational and educational purposes only. Nothing contained herein is investment advice or recommendations. No guarantee is provided about the accuracy or completeness of the information provided. Readers should consult their financial advisers to ascertain the suitability of any investment.

Contributors to Fincoaster may, from time to time, have positions in any investments discussed.

Fincoaster is operated and managed by Envision Ventures Limited.