Shining Bright: The Case for Including Gold in Your Investment Portfolio

Gold may be poised for continued strong performance

Gold has been on a tear recently, with the price of the previous metal nearing US$3,000/oz.

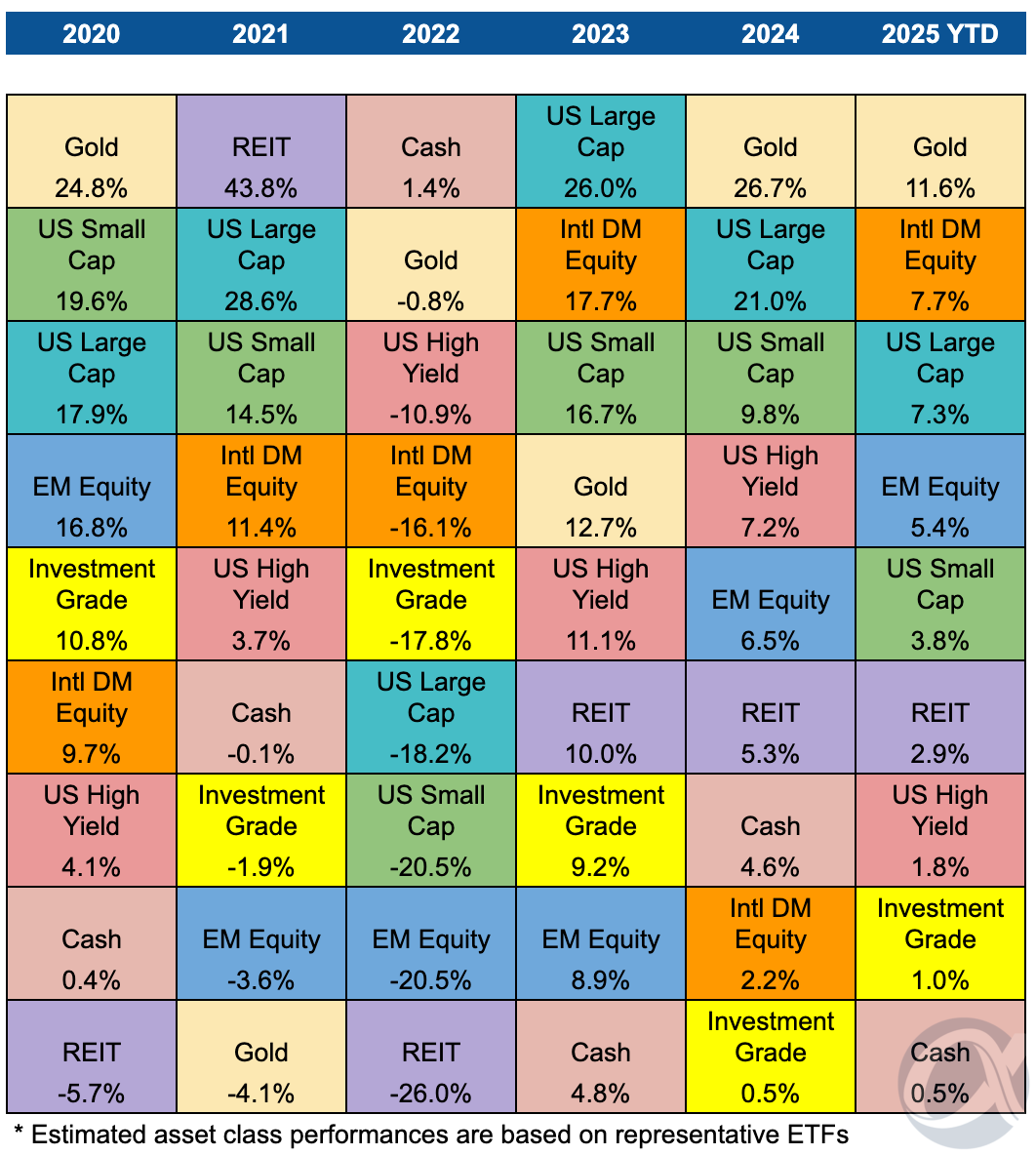

As seen below, gold was the top-performing asset class in 2024 and continues to outperform equities and fixed income in 2025.

Despite the historically high price, an allocation to gold could still be worth considering for your portfolio.

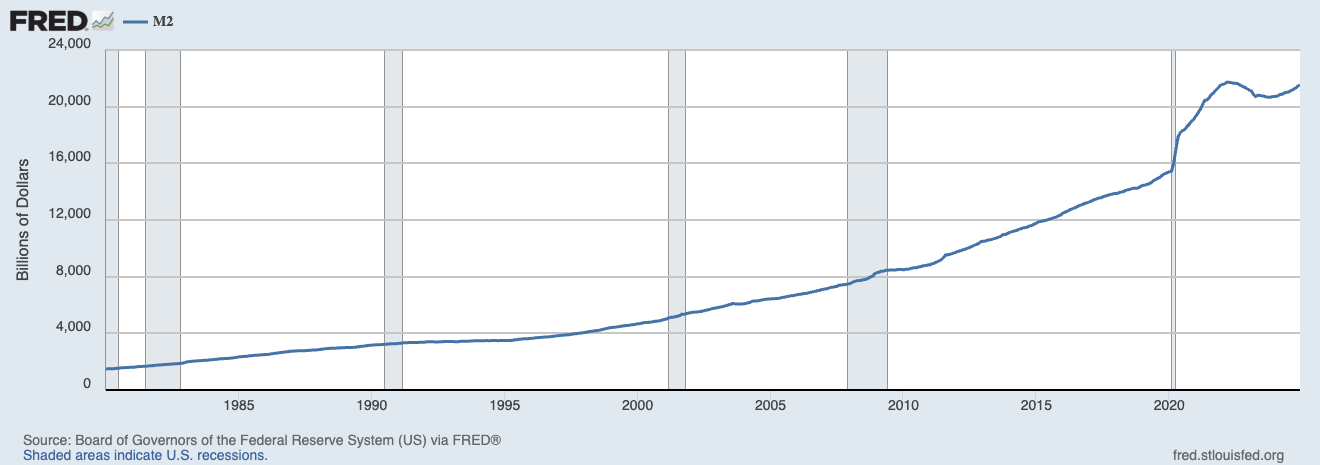

For one, it is important to note that when we talk of historically high gold prices, we are looking at gold relative to currencies that themselves are being debased or diluted.

This is reflected in the ever-growing stock of currency/money supply (see below), the reduced buying power of currencies, and the constantly rising costs of living.

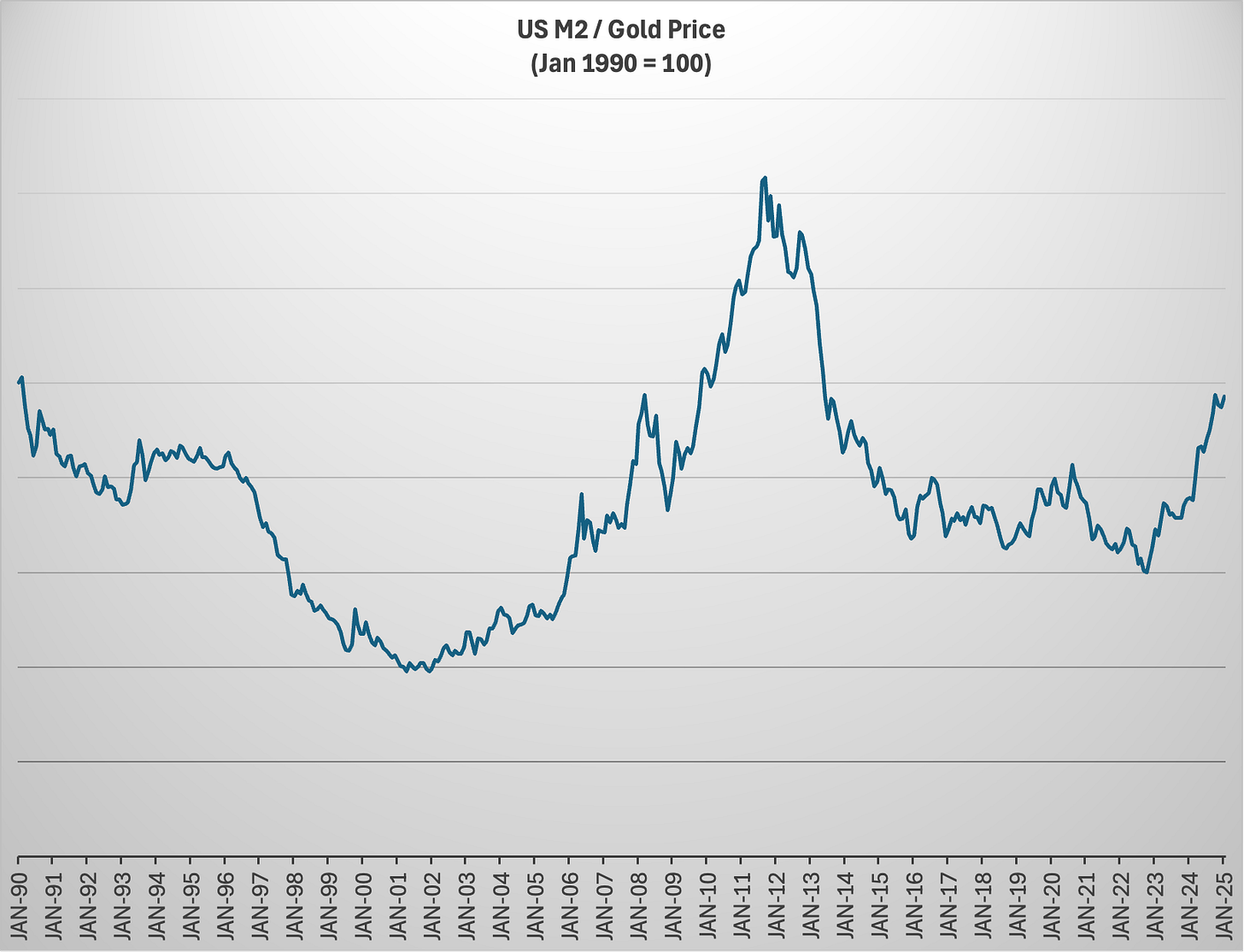

If we consider gold prices as a function of the money supply (M2/Gold price), current gold prices do not appear as extended.

The reasons to consider an allocation to gold include:

Proven ability to retain value and act as a hedge against inflation

Potential outperformance during times of economic and geopolitical uncertainty

Diversification benefits as the price of gold often don’t move in tandem with equity and fixed-income markets

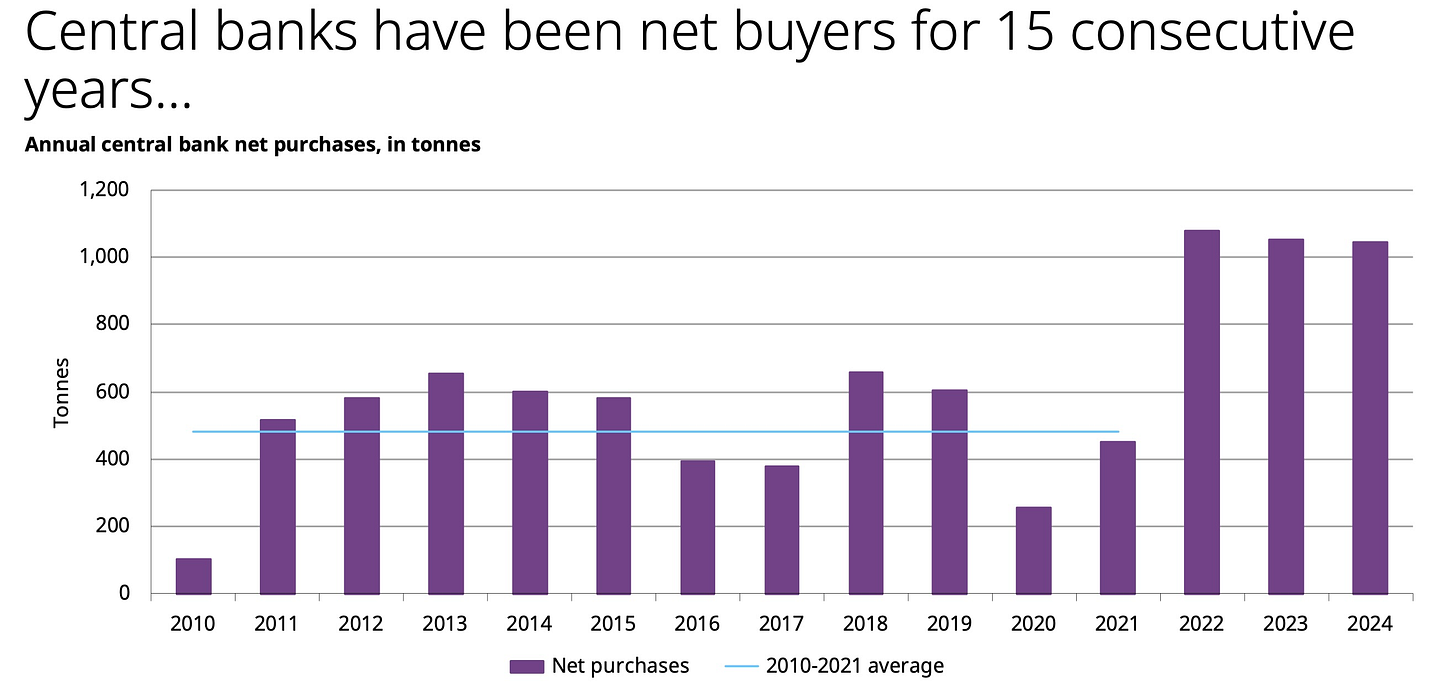

Another positive for gold is increased purchases by central banks. According to World Gold Council, central bank purchases of gold have topped 1,000 tonnes for three years in a row.

These purchases will likely remain part of their reserves for the long term, which is positive for gold markets.

For all its positives, investors must consider that gold does not pay any income, and prices can be highly volatile. As with all investments, it is crucial to consider how it fits into one’s overall portfolio and investment strategy.

Disclaimer:

Disclaimer:

All content, information and opinions provided on Fincoaster are for informational and educational purposes only. Nothing contained herein is investment advice or recommendations. No guarantee is provided about the accuracy or completeness of the information provided. Readers should consult their financial advisers to ascertain the suitability of any investment.

Contributors to Fincoaster may, from time to time, have positions in any investments discussed.

Fincoaster is operated and managed by Envision Ventures Limited.