The Monetary Disconnect - Fed Easing Meets Rising Bond Yields

Understand diverging yields and how you can benefit

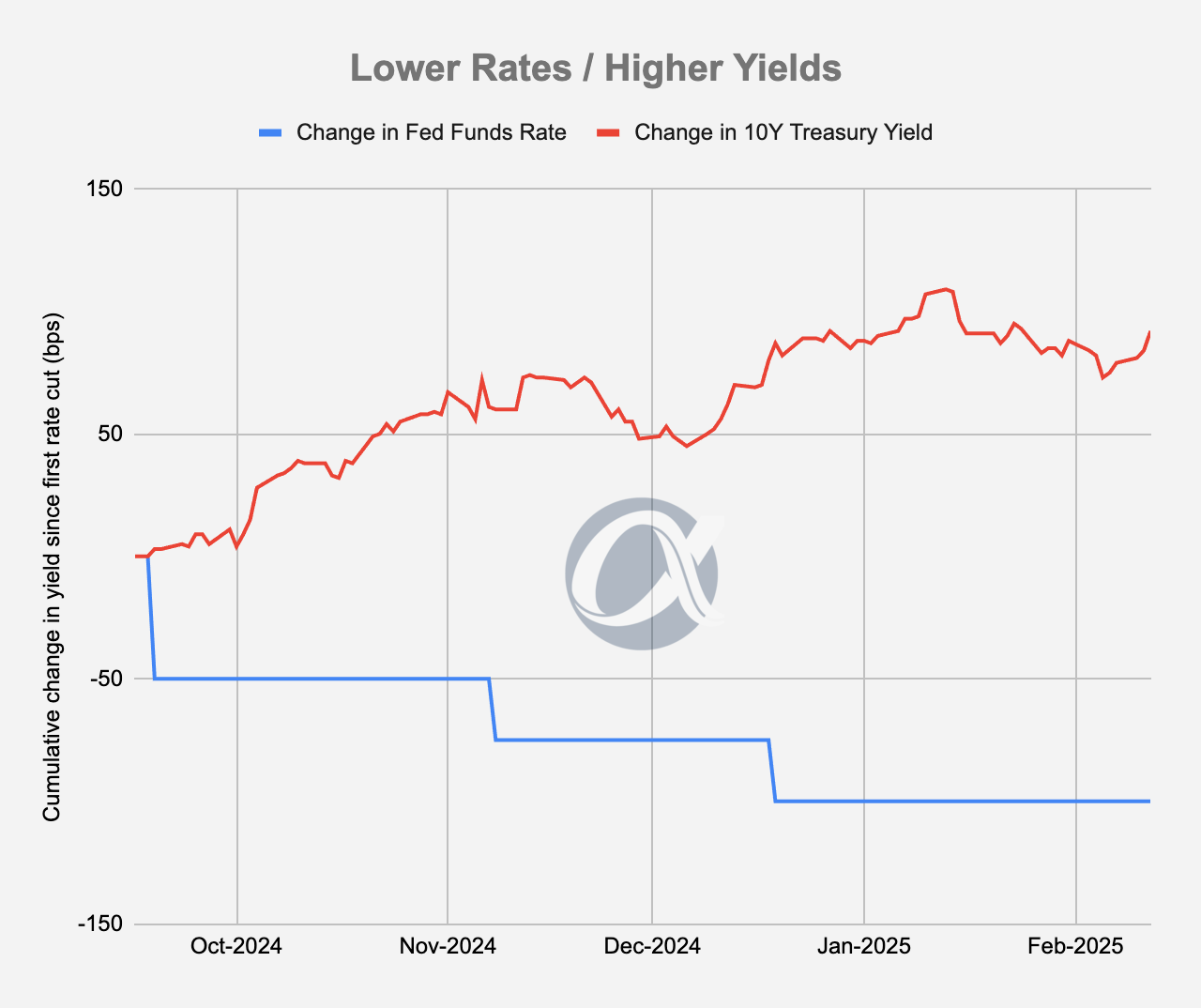

Since September 2024, the Federal Reserve has cut interest rates three times by a total of 100 basis points (1 percentage point). Conversely, the yield on a 10-year US government bond has risen by almost the same magnitude during that time (see chart).

So, while investors are getting lower yields on deposits and Treasury bills, medium-term and long-term bonds are offering higher yields compared to six months earlier.

The diverging paths of the Fed Funds Rate and bond yields are not typical. Bond yields have been driven higher recently amid renewed inflation worries, concerns about trade tariffs, and large fiscal deficits.

This is known as curve steepening and could create opportunities for discerning investors.

To dig in, we look at the following three aspects of the USD bond market:

The Federal Funds Rate (the overnight interest rate set by the Federal Reserve)

The Yield Curve (yields on US government bonds with different maturities)

Credit Spreads (incremental yields over government bonds, which can be earned by buying corporate bonds)

The Federal Funds Rate:

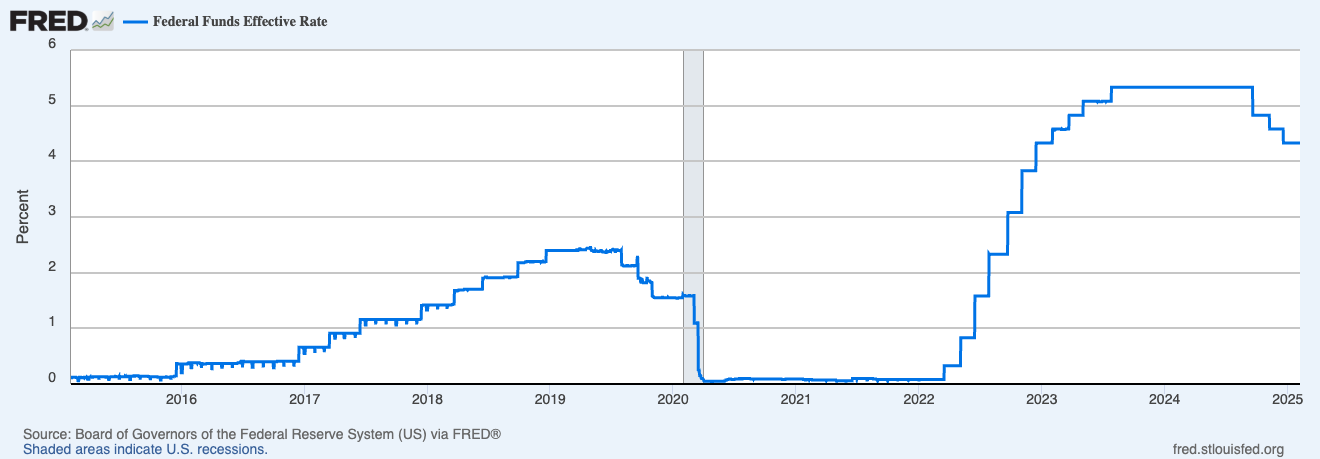

The Federal Reserve (like most global central banks) significantly hiked interest rates in 2022 and 2023 to combat high inflation. Starting in 2024, the rate was gradually cut as inflation pressures eased.

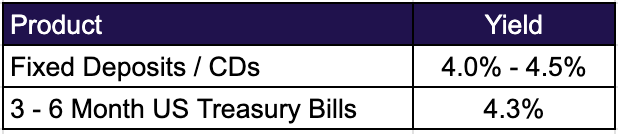

This rate is currently set at between 4.25% and 4.50% (see chart) and closely influences the yield on short-dated instruments such as T-bills and bank deposits. These are considered highly safe investment options from a credit risk standpoint, given that they are backed either by the underlying banks (for deposits) or the US government (for Treasury bills).

The yields on offer for these products have declined amid recent rate cuts. Additionally, with such short-term investments, one would need to consider re-investment risks: Because these instruments mature relatively soon, further rate cuts could result in funds being re-invested at lower interest rates in the future.

The US Government Yield Curve

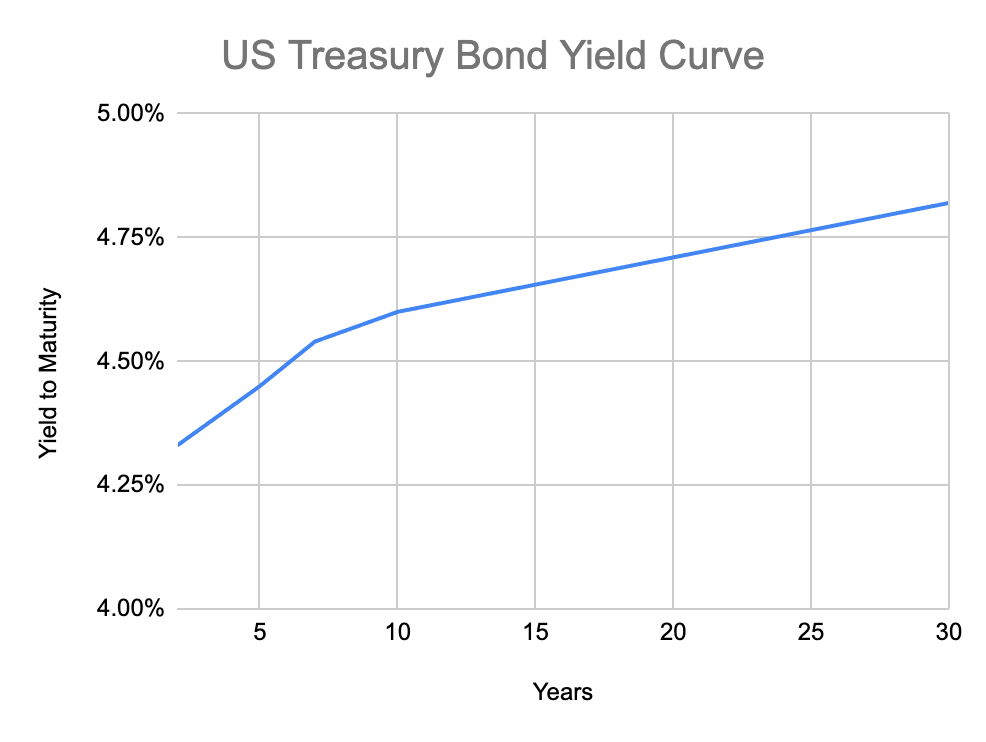

Considering longer-dated US government bonds can help address re-investment risks, as investors can 'lock-in' yields for longer periods.

The yield curve chart below shows the yields of US government bonds with different maturities. As the yield curve is positively sloping, investors can obtain higher yields by investing in longer-duration bonds. For example, US Treasury bonds with 5—or 10-year maturities offer yields of 4.5% and 4.6%, respectively.

However, it is essential to consider that the prices of these bonds can be volatile based on changing market yield levels. If bonds are sold prior to maturity, there could be gains or losses. In other words, the yields are only locked-in to the extent bonds are held to maturity.

Corporate Bond Opportunities

Bonds issued by corporations can offer even higher yields for investors with greater risk tolerance.

The incremental yields available on corporate bonds (credit spreads) help compensate for corporate default risks. The level of credit spreads available on individual bonds depends on the issuer's credit quality.

Bonds issued by higher-quality issuers, rated between AAA and BBB, are considered investment grade (or high grade). Meanwhile, bonds rated below BBB are referred to as high-yield or junk bonds.

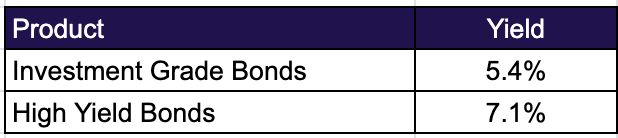

To get an idea of yield levels, we can look at the average yield of two major corporate bond ETFs.

Investors need to consider default risks carefully when considering corporate bonds. Companies with higher borrowing levels or sub-investment grade issuers have higher expected default rates.

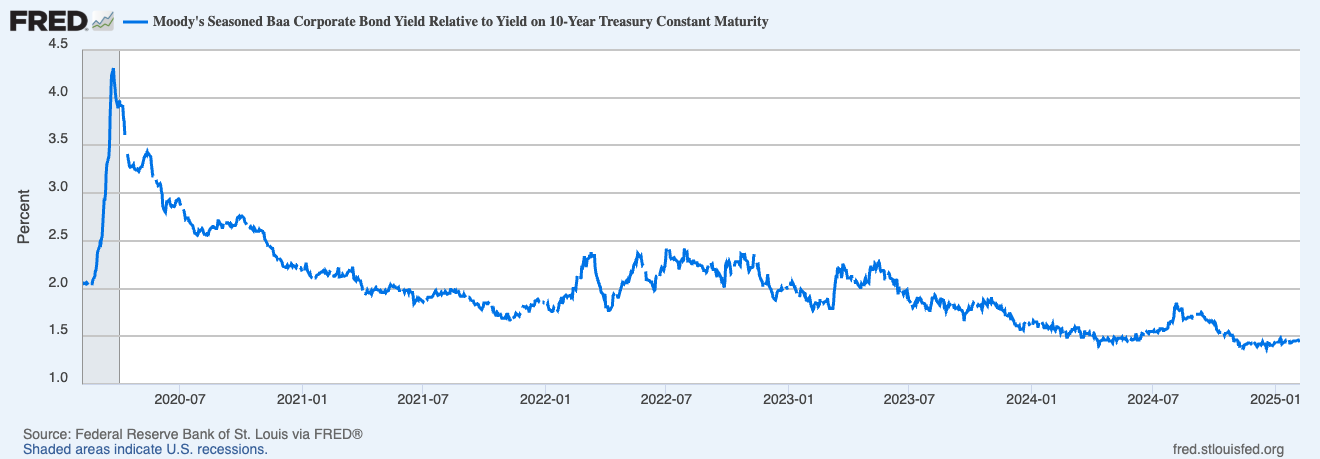

Another important consideration is that credit spreads are extremely low relative to historical levels. This reflects investor comfort with current economic conditions, which are generally supportive for corporates.

However, when the economy enters a slowdown or recession, corporate risks increase. Spread levels need to adjust higher, and investors may suffer the impact of lower corporate bond prices and/or a pick-up in default rates.

Given the low credit spread levels, it would be best to be highly selective when investing in corporate bonds and stick to higher-quality and better-rated issuers.

Bringing it all together

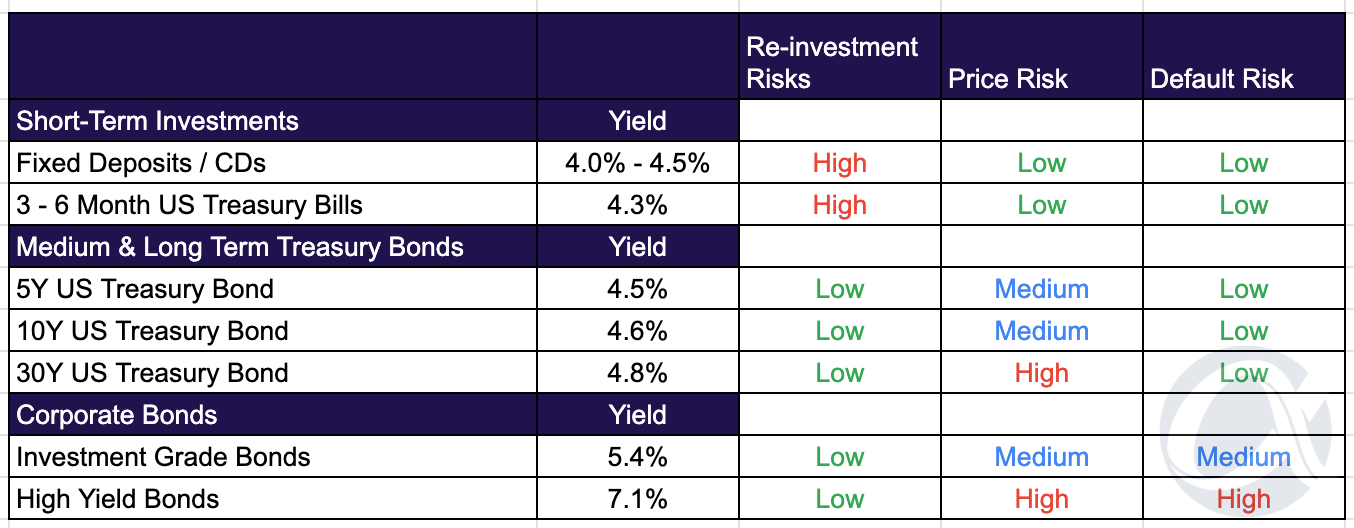

The table below brings together the yields and risks available on the fixed-income options discussed:

Although expectations for additional rate cuts have receded recently, investors with excessive short-term fixed-income investments may consider allocations in medium-term Treasury bonds for additional yield and locking-in returns for longer periods.

If the bonds are not held until maturity, there may be an added risk of price volatility. However, this can be managed by controlling allocations to longer-dated bonds within your overall portfolio. Additionally, note that price volatility works both ways—bond prices may also climb if rate cut expectations increase should the economy hit a soft patch.

As mentioned, with corporate bonds, given the tight credit spreads, investors should be very selective.

Disclaimer:

All content, information and opinions provided on Fincoaster are for informational and educational purposes only. Nothing contained herein is investment advice or recommendations. No guarantee is provided about the accuracy or completeness of the information provided. Readers should consult their financial advisers to ascertain the suitability of any investment.

Contributors to Fincoaster may, from time to time, have positions in any investments discussed.

Fincoaster is operated and managed by Envision Ventures Limited.