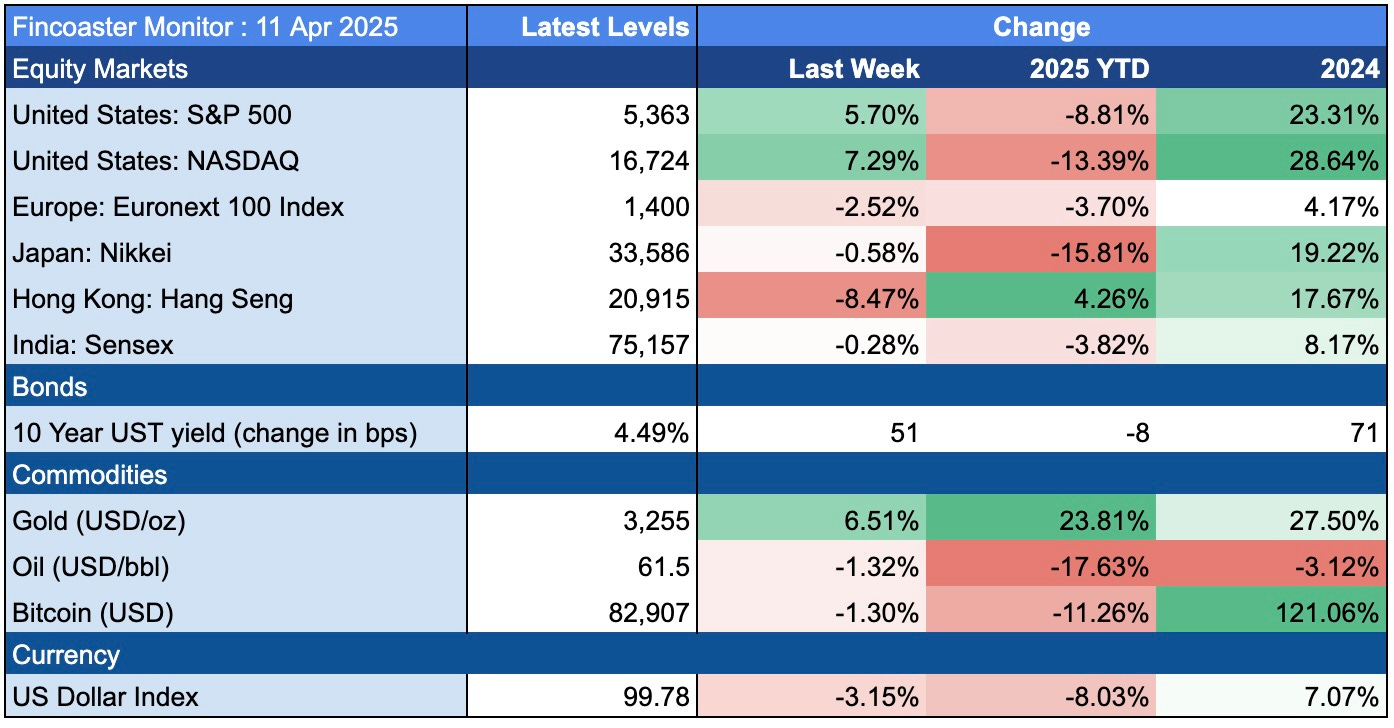

Fincoaster Weekly - 11 April 2025

Equities rebound on U.S. tariff reversal, but policy flip-flop might be denting the perception of U.S. exceptionalism

Happy Saturday,

Welcome to Fincoaster's weekly newsletter!

U.S. President Donald Trump blinked this week, announcing a 90-day pause in reciprocal tariffs for countries except China. Warnings from CEOs and economists, collapsing equity markets and dislocations in bond markets likely all contributed to the about-face.

As a result of the tariff reprieve, U.S. equity markets rebounded strongly. However, the erratic policymaking seems to have dented the perception of U.S. exceptionalism further, with the U.S. dollar selling off and gold setting new record highs.

Below, we look into events of the week and what to look out for next week.

The Week That Was

U.S. equity markets rebounded this week following President Trump's 90-day pause in implementing reciprocal tariffs.

The S&P 500 and NASDAQ climbed by 5.7% and 7.3% respectively for the week.

Hong Kong markets underperformed this week due to a holiday last Friday, which pushed selling into this week. Moreover, with the U.S. trade war now focused increasingly on China, it is not surprising that investors remained cautious about Hong Kong equities.

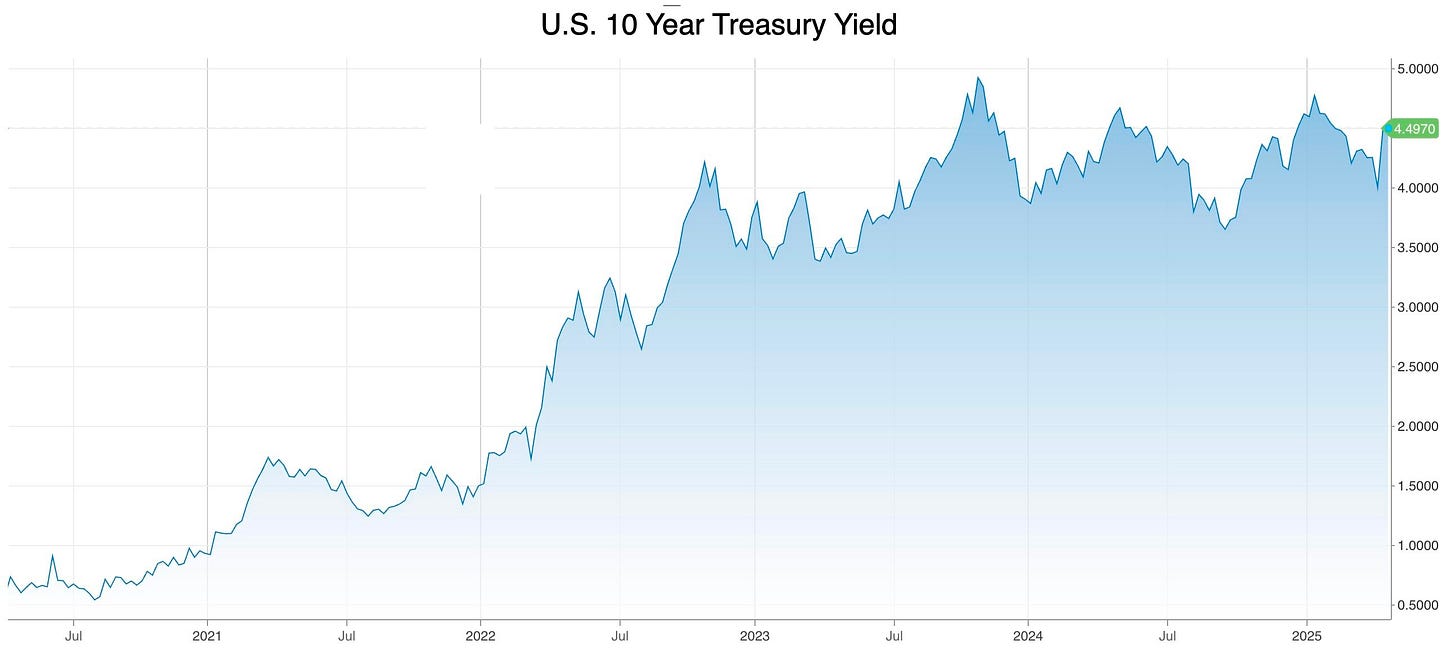

Bond yields rebounded during the week as investors unwound flight-to-safety trades.

10-year U.S. Treasury yields rose by 51 bps (0.51 percentage points) to 4.49% as the pause in tariff implementation provides some breathing room for economies and opens a window for trade deals, thereby reducing the risks of an immediate economic collapse.

Yields are now close to the highest levels seen this year despite recession probabilities remaining high (see chart below)

If the U.S. does face a recession, the Federal Reserve may be forced to cut interest rates aggressively to support the economy. This in turn could be positive for bonds. (see our chart of the day (1) below for rate cuts expected by futures markets)

The other notable movement in the markets this week was the drop in the U.S. dollar.

The U.S. dollar index declined by 3.15% to 99.78, and is now down over 8% this year.

The flip-flop over investor tariffs has caused concern about U.S. policy stability and, by extension, the status of the U.S. dollar. Safe-haven currencies, including the Swiss Franc and Japanese Yen, outperformed.

The fall in the U.S. dollar was also massively supportive of gold. The precious metal climbed by 6.5% this week to US$3,255 per ounce - and is now up over 23% this year. (See our post earlier in the year stating the investment case for gold)

What Does it All Mean?

Although reciprocal tariffs have been put on hold, a recession may already be baked into the cake.

Moreover, the geopolitical balance is highly fluid, with ongoing trade wars (currently focused on China) and continued military conflicts in various parts of the world.

Thus, equities will likely remain volatile and investors should carefully manage their allocations. Asset classes such as gold and bonds could provide diversification benefits to portfolios. (See our post on asset allocation)

See our chart of the day (2) for updated asset class performances.

What to look out for next week

Any updates related to trade tariffs and policies would continue to be major drivers across asset classes. While reciprocal tariffs (except for China) are paused for 90 days, the clock will be ticking for countries to strike deals with the U.S.

We will get more U.S. companies reporting Q1 2025 earnings. These could provide valuable insights into how tariff headlines and high interest rates are affecting consumer spending and corporate strategy.

One should also monitor the U.S. dollar closely. Further weakness in the greenback could shake confidence in financial markets.

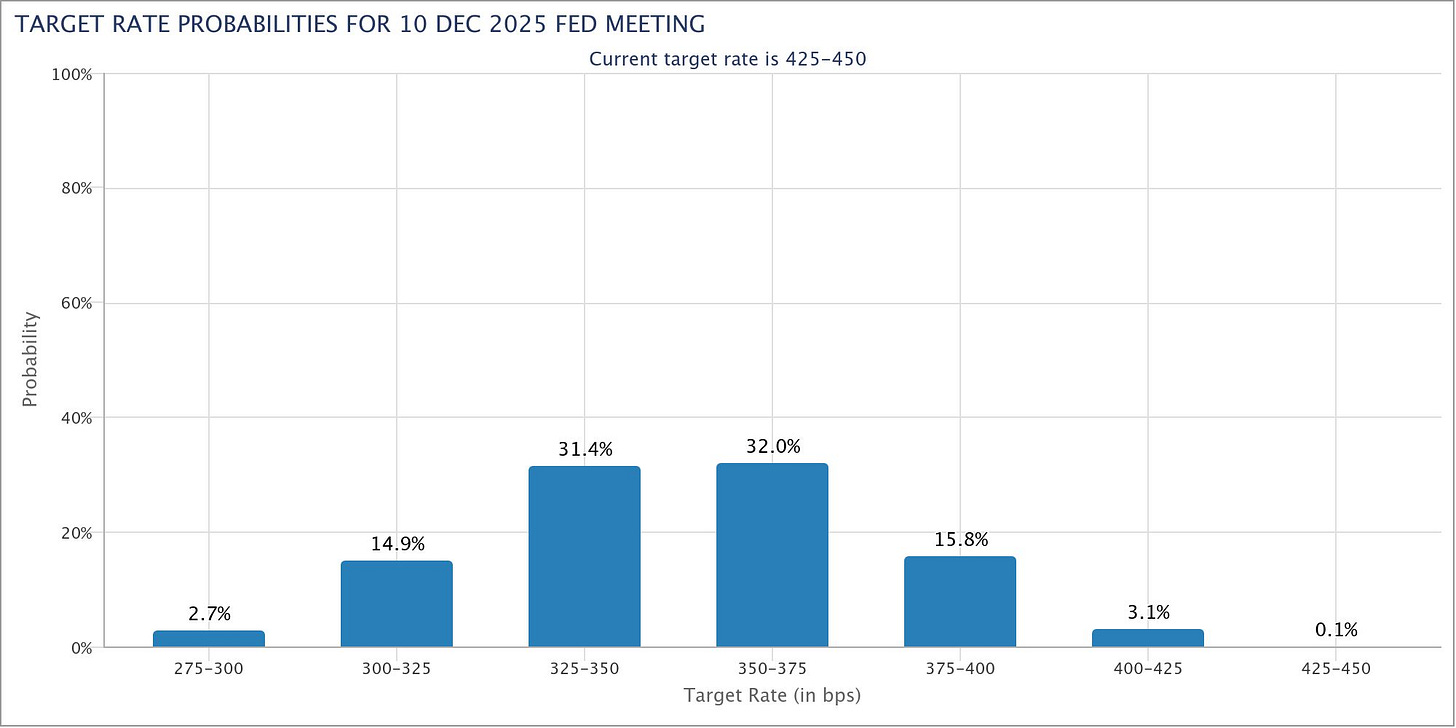

Chart of the Week (1)

The below chart shows the market expectation of the Fed Funds rate by year-end.

The current Fed Funds Rate is 4.25% - 4.50%.

As seen, futures markets expect the rate to be between 3.25% - 3.50% and 3.50% - 3.75% by December - This implies 3 or 4 25-bps rate cuts this year.

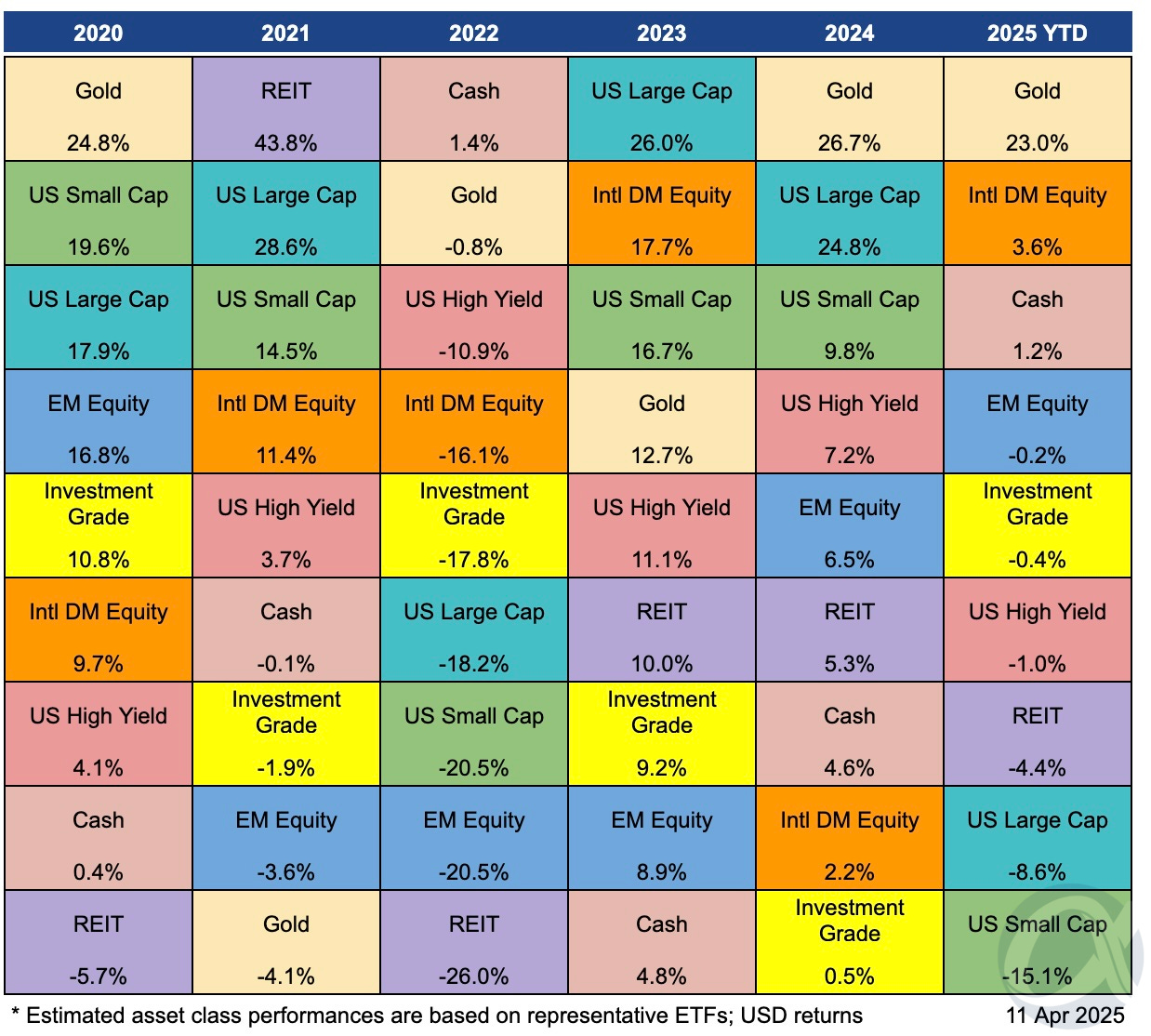

Chart of the Week (2)

The table below updates the 2025 year-to-date performance of major asset classes (in USD terms).

Gold remains the stand-out performer — reflecting economic uncertainty, U.S. dollar weakness and continued central bank purchases.

All other assets are struggling, with gains in international equities mainly reflecting U.S. dollar weakness rather than positive price performance.

Even bonds have recently given up gains as government bond yields increased and credit spreads widened. (See our post on higher bond yields and possible opportunities)

Thank you for reading. Please share the newsletter with those who may benefit.

Suvir Mukhi | Fincoaster.com

Disclaimer:

All content, information and opinions provided on Fincoaster are for informational and educational purposes only. Nothing contained herein is investment advice or recommendations. No guarantee is provided about the accuracy or completeness of the information provided. Readers should consult their financial advisers to ascertain the suitability of any investment.

Contributors to Fincoaster may, from time to time, have positions in any investments discussed.

Fincoaster is operated and managed by Envision Ventures Limited.