Inflation Explained: Protecting the Value of Your Savings

What causes inflation and why modest inflation is desired

We witness inflation daily, with the prices of things we purchase rising higher and higher. Hence, it is essential to understand why inflation is a constant factor in our lives and the importance of protecting savings from inflation.

We explore what causes inflation and why a modest degree of inflation may actually be desirable for economies.

What is Inflation? Inflation is the rate at which prices increase. It is usually measured on a broad basis to reflect the rate at which the cost of living is increasing yearly.

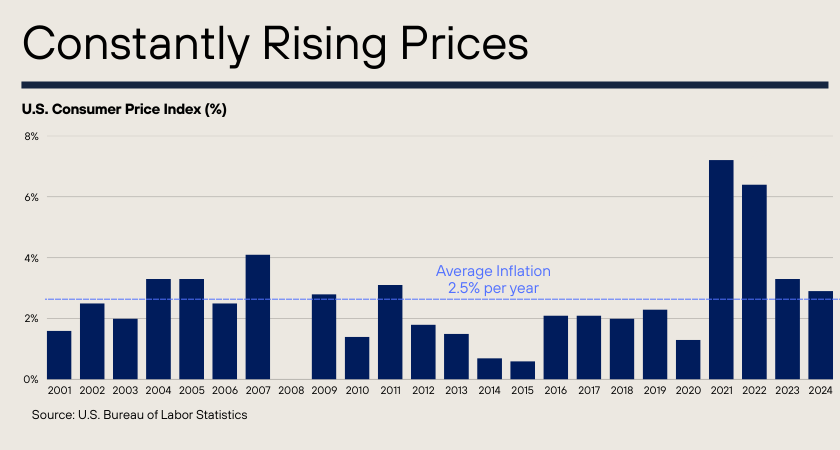

The chart below shows the U.S. consumer inflation rate for each year between 2001 and 2024. The rate was positive every year except one, meaning prices were constantly climbing.

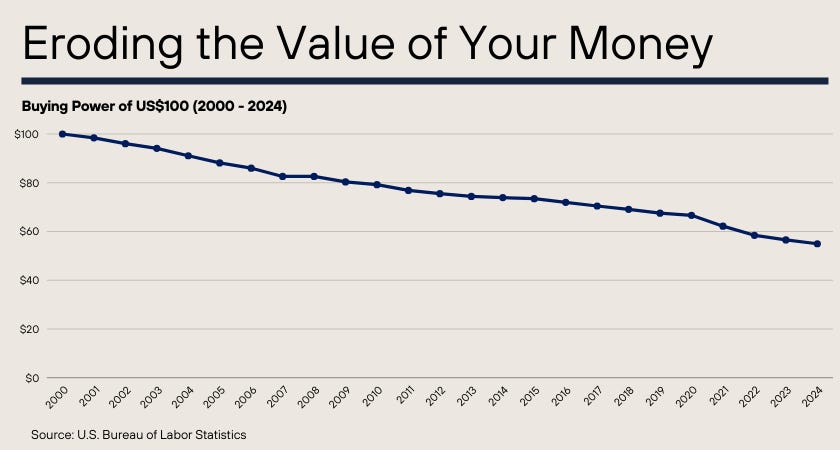

Importantly, inflation affects not only the money you spend but also the value of your savings. Just consider putting a US$100 note in a savings jar and keeping it there for five years. While nothing would happen to the note itself, due to inflation, what you could purchase with the note five years later would have been reduced.

This decline in the purchasing power of money due to inflation compounds over time. If inflation is running at 3% per year, in five years, the US$100 note would only be able to buy you things worth US$86 presently!

The chart below illustrates the eroding buying power of US$100 between 2000 and 2024, based on the above U.S. inflation data.

What causes inflation?

Now that we have established inflation's persistence and impact on money's purchasing power, we can examine its causes.

Multiple factors influence the prices of commodities, products, and services, including changes in consumption patterns, supply dynamics, and logistical considerations. For example, an increased population may drive up housing prices, or droughts could cause food prices to rise.

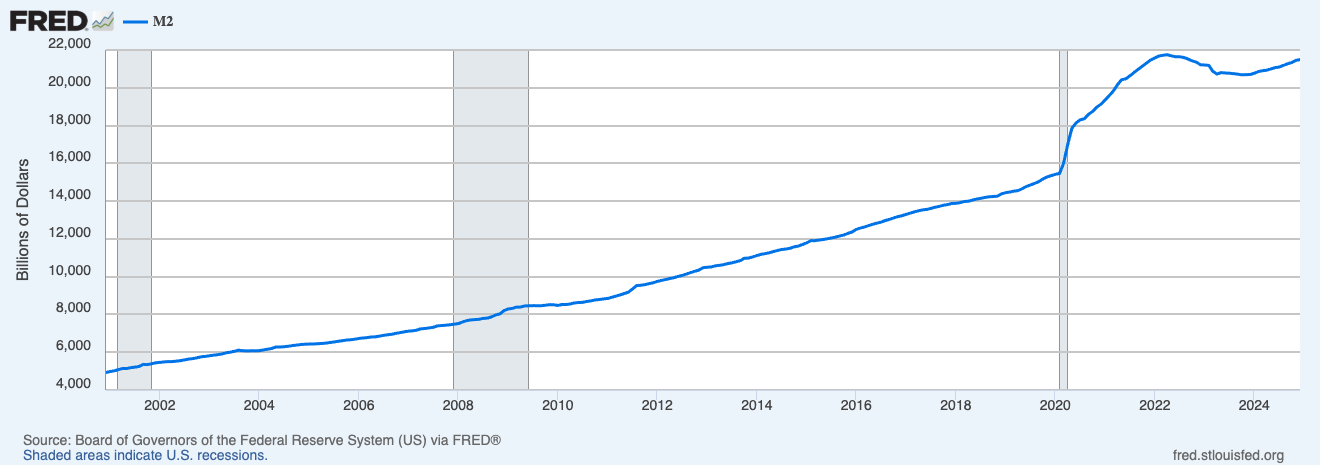

However, on an aggregate level, inflation is driven mainly by the increase in the amount of money in the system (i.e. money supply). The increase in overall money held by the public relative to the size of the economy drives inflation. What is commonly referred to as 'money printing' actually encompasses the following three ways the money supply can be increased:

Central Bank Actions (Monetary Policy): This includes purchasing securities from the market (e.g. open market operations, quantitive easing), adjustments to bank reserve requirements, and changes in interest rates.

Commercial Bank Lending: Due to the fractional reserve system, consumers and businesses borrowing money from banks leads to money creation.

Government Spending (Fiscal Policy): Increased deficit spending by governments, especially when central banks purchase bonds, also injects new money into the system.

So money isn't physically printed—banks and central banks digitally create it through the above means. Inflation usually picks up when the rate of new money creation is excessive.

The chart below from the U.S. Federal Reserve shows the growth in the stock of money in the U.S., including money in circulation, bank deposits, and money market fund balances. The number has more than quadrupled since 2000!

Why is modest inflation targeted? As consumers, we may not want to see the prices of things we buy climb. We would rather see prices decline. However, this may not be desirable for the economy as a whole.

For example, if prices were constantly declining (deflation), consumers would be incentivised to delay purchases because they could buy things cheaper in the future. This would result in less business activity, recessionary conditions, and eventually job losses.

Additionally, borrowers would find it increasingly difficult to service their loans in an environment where prices are declining, as there would be lower sales and profits for businesses and reduced salaries for individuals. Effectively, economies risk entering 'deflationary spirals.'

Hence, most economists believe that low and stable inflation (gradual price rises) is ideal for keeping the economy chugging along. There is enough incentive for consumers to spend when they need to, and the value of money is not eroded too rapidly for people to lose faith in the currency.

For this reason, when the economy is slowing, and inflation is dropping below target levels, central banks take actions, such as reducing interest rates, to encourage borrowing. The opposite is done when inflation is running hot.

Protecting your wealth from inflation: Given that inflation will remain a constant force, it is essential to consider ways to preserve the value of your savings over time.

Bank deposits are unlikely to keep you ahead of inflation because interest rates are not usually meaningfully above inflation levels for sustained periods. Hence, you need to consider other asset classes offering higher return potential.

Historically, equities have outperformed inflation over the long term. This reflects companies' ability to raise prices over time and innovate, both of which lead to higher profits and stock prices.

Real estate and commodities, such as gold, also tend to retain value during inflationary periods. See our posts on investing in real estate investment trusts (REITs) and the case for gold.

Although bonds typically offer lower returns than equities, they may still play an important role in your portfolio, given their lower volatility and potential to outperform in certain environments.

Some bonds have inflation protection features. For example, U.S. government Treasury Inflation-Protected Securities (TIPS) adjust their principal value based on inflation.

Final Thoughts

Inflation is an unavoidable economic force, but a diversified portfolio with stocks, real estate, bonds, and commodities can provide a strong defence against rising prices.

When constructing and managing your portfolio, it is important to consider the risk profiles of different asset classes. See our post on asset allocation for more information.

Also, remember that it may be okay for some parts of your portfolio to offer projected returns below inflation. For example, bank deposits or money market fund investments offering lower but steady returns may help cover near-term expenses or reduce overall portfolio volatility. Alternatively, these could be tactical allocations to allow you to take advantage of future volatility in other asset classes.

Lastly, when considering investments, it is important to focus on total returns, not just yields. Stocks and REITs may have high historical dividend yields, but price volatility could result in significantly higher or lower total returns.

Similarly, for bonds, changes in interest rates could cause returns to be significantly higher or lower than the yields at the time of purchase if the bonds are not held till maturity. With riskier bonds credit risks must also be accounted for.

Disclaimer:

All content, information and opinions provided on Fincoaster are for informational and educational purposes only. Nothing contained herein is investment advice or recommendations. No guarantee is provided about the accuracy or completeness of the information provided. Readers should consult their financial advisers to ascertain the suitability of any investment.

Contributors to Fincoaster may, from time to time, have positions in any investments discussed.

Fincoaster is operated and managed by Envision Ventures Limited.