Fincoaster Weekly - 4 April 2025

Equities plunge while bonds rally on tariffs; RH calls the U.S. housing market the "worst in almost 50 years."

Happy Saturday,

Welcome to Fincoaster's weekly newsletter!

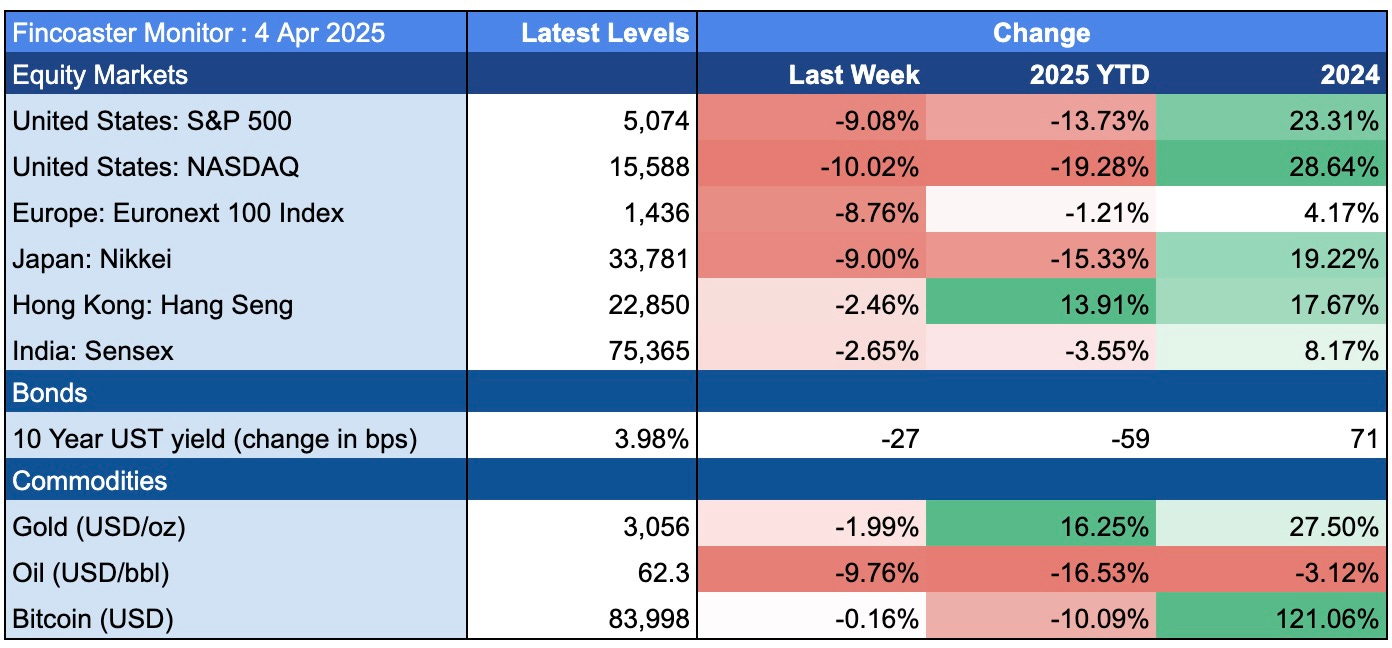

Global equity markets plunged this week after U.S. President Donald Trump announced harsher-than-expected tariffs. The escalating trade war adds risks to global economies, and economists are raising recession probabilities.

Bonds continued to rally, with the 10-year U.S. Treasury yield dropping below 4% as investors sought safety from falling stocks.

Below, we look into events of the week and what to look out for next week.

The Week That Was

Global equity markets crashed this week led by the NASDAQ, which was down over 10% and entered bear-market territory (down over 20% from its recent high).

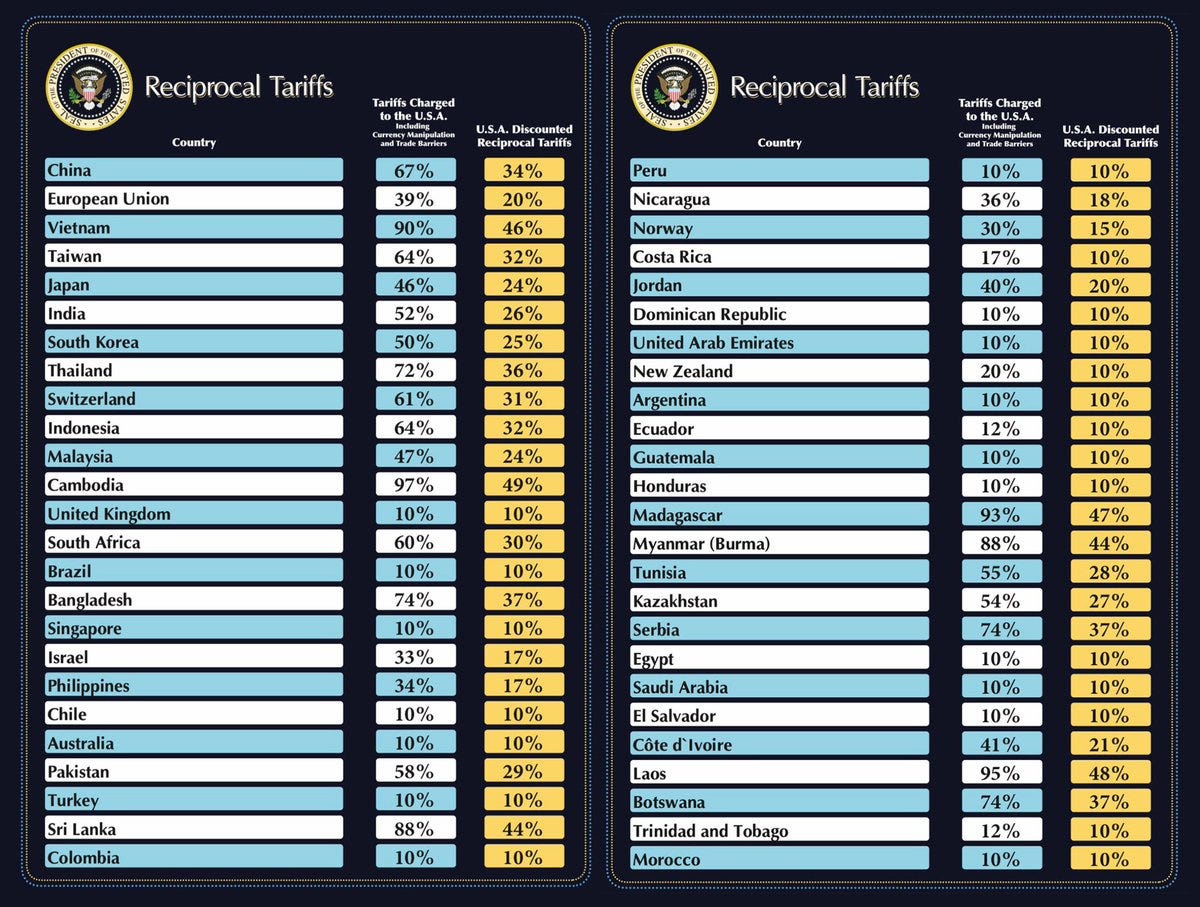

The global equity sell-off was triggered by a 'worst-case' tariff outcome announced on April 2. The table below from the White House "Liberation Day" announcement details the reciprocal tariffs to be levied on imports to the U.S.

The much higher-than-expected tariffs will further damage already weak consumer and business sentiment and increase recession risks. Additionally, the tariffs risk igniting inflation. See our post on inflation.

China has already announced retaliatory tariffs, and other countries could follow, adding to uncertainties for the global economy and, by extension, markets.

RH (formerly Restoration Hardware) added to the list of companies warning about the state of the U.S. economy. The American home-furnishings company issued a weaker-than-expected outlook saying that it is facing "the worst housing market in almost 50 years."

RH's stock dropped over 40% following the update.

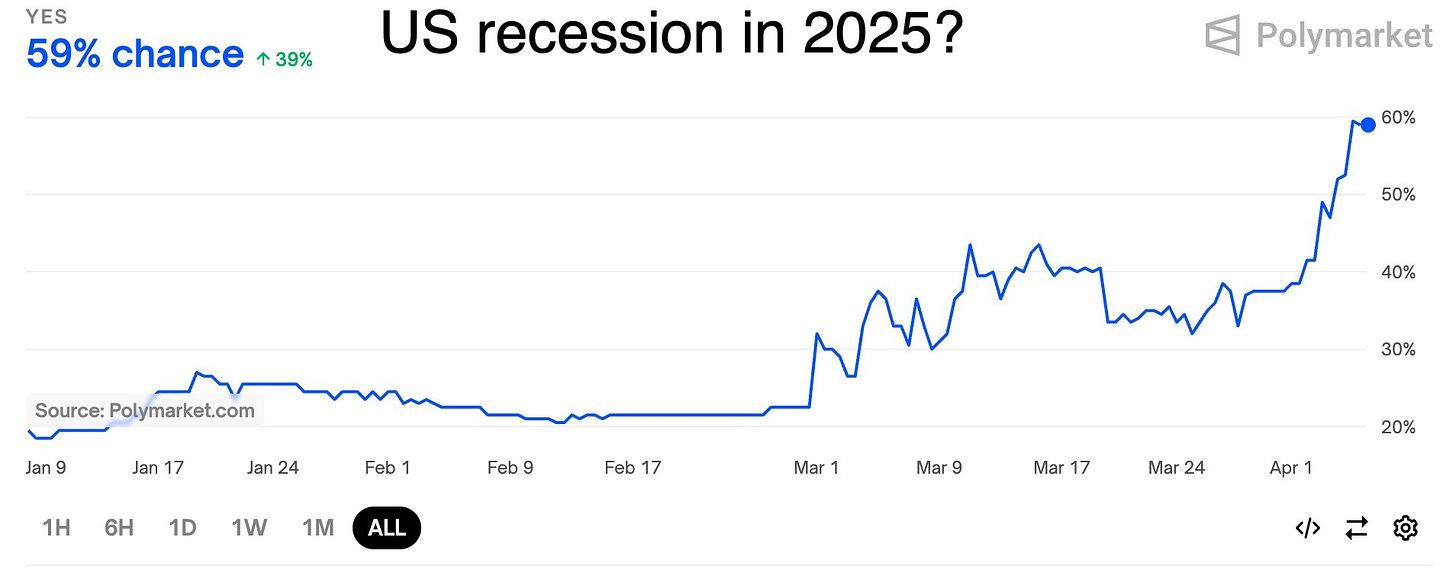

At predictions market Polymarket, the chances of a U.S. recession in 2025 have skyrocketed to 59%.

Given increased recession risks, expectations for rate cuts have climbed. Futures markets now expect 3 to 4 rate cuts during the year, which has also been reflected in rallying bond prices.

However, for now, Federal Reserve Chair Jerome Powell is projecting a wait-and-see approach. In a Friday speech, Powell said he expects tariffs to raise inflation and lower growth but would wait for more certainty before acting on rates:

"We are well positioned to wait for greater clarity before considering any adjustments to our policy stance. It is too soon to say what will be the appropriate path for monetary policy." — Jerome Powell.

What Does it All Mean?

The high level of uncertainty created by the tariff announcements and the potential for retaliations are likely to keep consumers and businesses cautious and further weigh on economic growth.

Thus, recession risks are high. Although the Federal Reserve is not yet committing to rate cuts, it is quite likely that they will be forced to drop interest rates to cushion the economy.

Investors must carefully manage their asset allocations as equities could remain volatile. See our post on asset allocation.

What to look out for next week

The market will continue to digest the implications of the tariffs and closely watch how trading partners react. This will be key in determining whether investors will further sell equities and rush into safe-haven assets such as bonds and gold.

Chart of the Week (1)

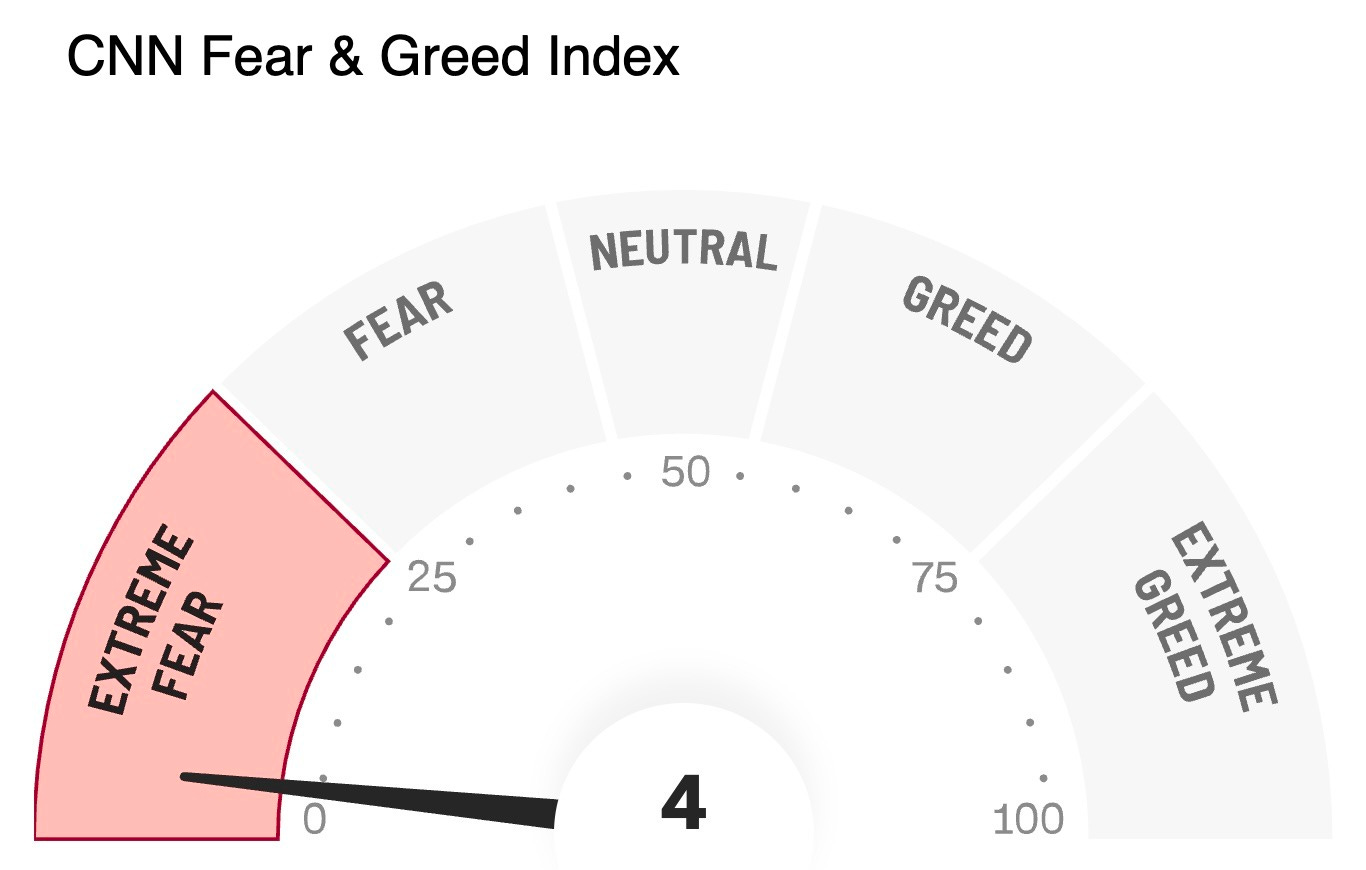

CNN's Fear & Greed Index dropped further into the "Extreme Fear" zone, reflecting extremely nervous investor sentiment.

Investors sometimes consider extremely weak sentiment to indicate oversold conditions, which could lead to technical bounces.

However, given the highly uncertain macro environment, any such bounce could be short-lived.

Chart of the Week (2)

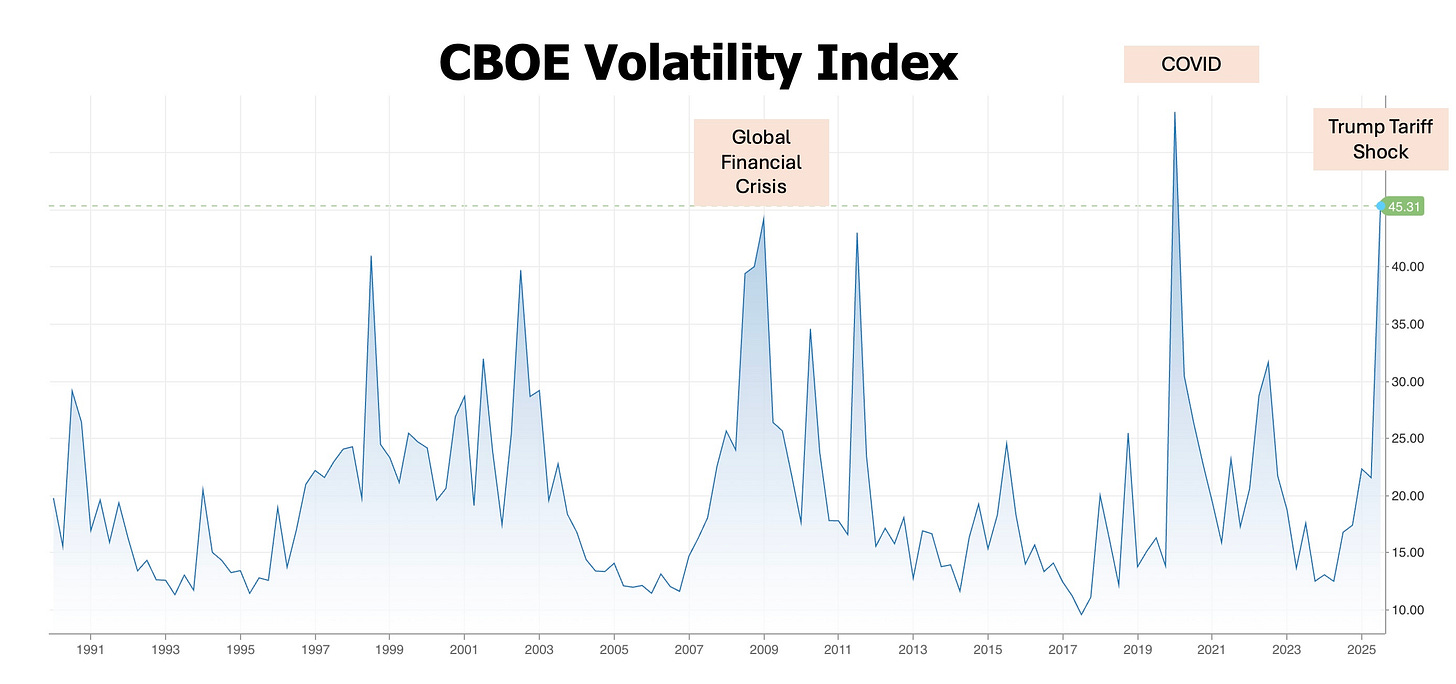

The Cboe Volatility Index (VIX) spiked as equity markets sold off. The VIX index closed the week at 45 - closing levels previously seen during the Covid period and the Global Financial Crisis.

The index reflects the expected equity market volatility priced into option markets. Higher readings indicate that option traders expected stocks to be more volatile in the near term. Put option buyers were active, looking to protect against further equity declines.

Thank you for reading. Please share the newsletter with those who may benefit.

Suvir Mukhi | Fincoaster.com

Disclaimer:

All content, information and opinions provided on Fincoaster are for informational and educational purposes only. Nothing contained herein is investment advice or recommendations. No guarantee is provided about the accuracy or completeness of the information provided. Readers should consult their financial advisers to ascertain the suitability of any investment.

Contributors to Fincoaster may, from time to time, have positions in any investments discussed.

Fincoaster is operated and managed by Envision Ventures Limited.