Warren Buffett Sells Apple and Bank of America; Doubles Cash Position

Share disposals double cash position to over US$300 billion -- What does it mean for your portfolio?

Based on recent cash-raising efforts at Berkshire Hathaway, famed investor Warren Buffett may be getting increasingly cautious about the US stock market.

The company's latest annual report reveals a record cash balance of US$324 billion as of December 2024. The doubling of its cash position is due to selling some blue-chip equity positions, as shown below.

Cash as a percentage of total assets is also the highest in years.

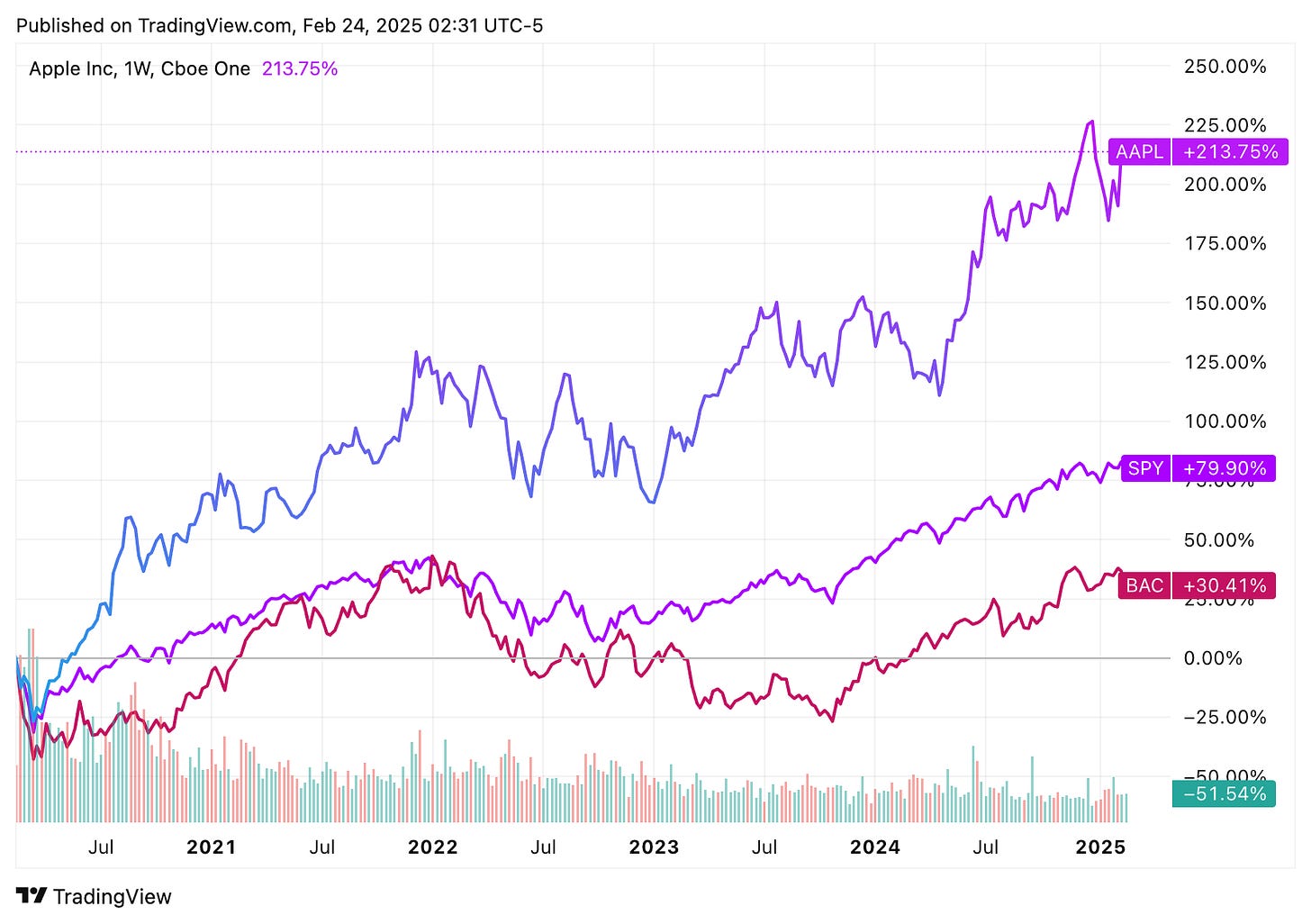

Which positions were sold? Regulatory filings show that Apple and Bank of America holdings were reduced sharply in 2024. The Apple holding was cut by two-thirds, while the Bank of America holding was lowered by one-third.

Part of the reason behind the sales could be profit-taking following strong runs in US equity markets over the last few years. This is especially the case for Apple (AAPL), which has significantly outperformed the broader market (SPY).

However, the sales also likely represent caution regarding overall equity valuations relative to corporate earnings, the economic situation and trade tariff uncertainties.

Hence, Warren Buffett is most likely taking some profits and also maintaining dry powder to invest when more attractive opportunities arise—possibly after a market correction.

What does this mean for your portfolios?

Timing the market is very difficult and not for everyone. Hence, you need to focus on your long-term asset allocation (see related post). Unless you are overly exposed to US equities, you probably don't need to do too much.

Even Warren Buffett's shareholder letter seeks to reassure investors on this front. He notes that Berkshire Hathaway's equity investments still remain significant, especially when considering unlisted equities.

Further, US equities would remain the company's core allocation. Buffett highlights equities' advantage over cash and bonds when it comes to beating inflation.

Thus, Warren Buffett remains a believer in long-term equity potential, and recent sales are likely an opportunistic and tactical move. While Berkshire Hathaway may not see compelling opportunities currently, it is well-positioned to capitalise when it does. We will closely monitor when and where cash is re-invested in the coming quarters.

For more details of Warren Buffett's and other famous investors' equity holdings, see our related post: 4Q2024 Legendary Portfolios.

Disclaimer:

All content, information and opinions provided on Fincoaster are for informational and educational purposes only. Nothing contained herein is investment advice or recommendations. No guarantee is provided about the accuracy or completeness of the information provided. Readers should consult their financial advisers to ascertain the suitability of any investment.

Contributors to Fincoaster may, from time to time, have positions in any investments discussed.

Fincoaster is operated and managed by Envision Ventures Limited.