Fincoaster Weekly - 9 May 2025

U.S. equity markets were slightly lower this week -- consolidating after two strong weeks; Important U.S. - China meeting this weekend

Happy Saturday,

Welcome to Fincoaster's weekly newsletter!

U.S. equity markets were slightly weaker this week — consolidating after two strong weeks.

Below, we examine the market action this week and discuss what to look for next week.

The Week That Was

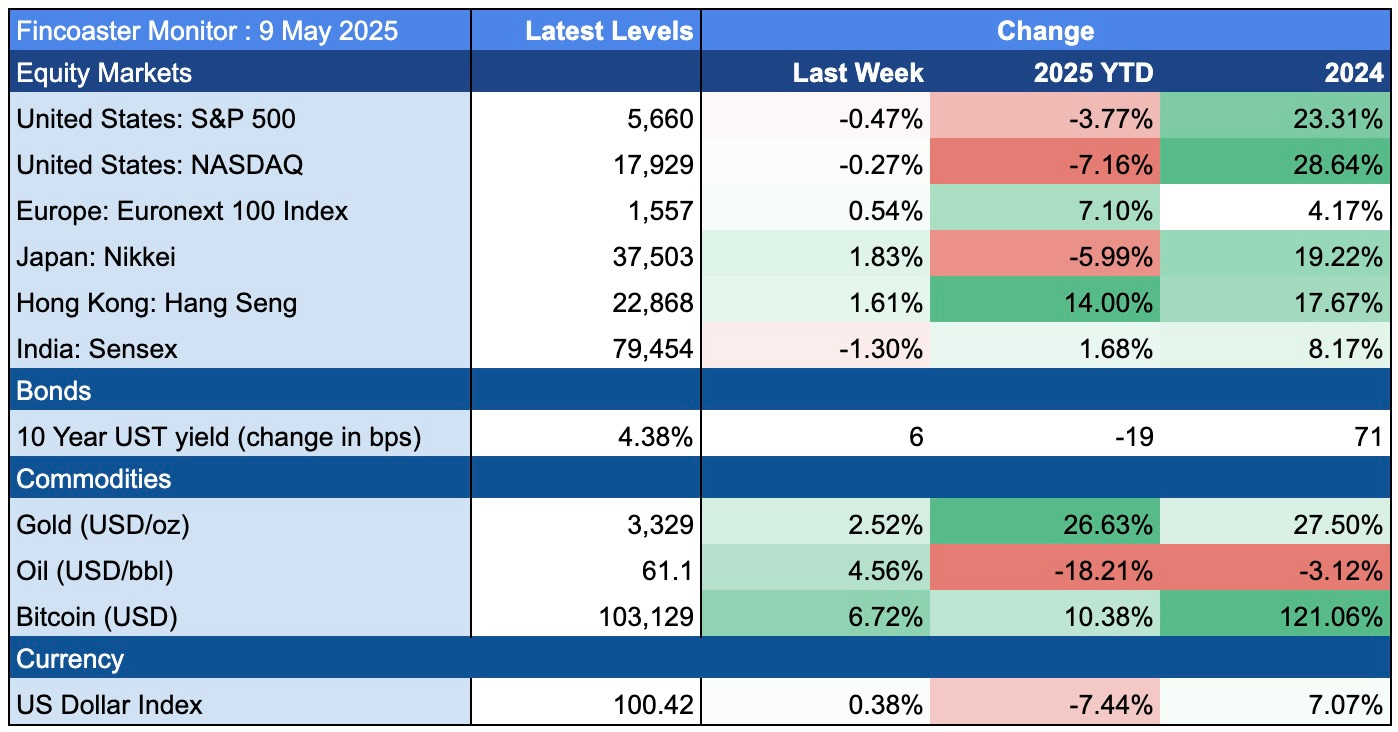

U.S. stock markets were slightly lower this week, with the S&P 500 and NASDAQ lower by 0.47% and 0.27%, respectively.

After a couple of strong weeks, it is not surprising that markets have consolidated.

During the week, the Federal Reserve decided to keep interest rates unchanged, which was in line with expectations. However, the markets continue to expect around three cuts for the remainder of the year.

On the trade front, President Trump unveiled a trade agreement with the U.K. and the market and is closely anticipating this weekend's trade meeting between the U.S. and China.

The U.S. dollar recovered further - continuing to hold the psychologically important 100 level.

What Does it All Mean?

Equity markets have clawed back all their losses since the tariff announcement due to the 90-day pause in retaliatory tariffs and hopes that trade deals with major partners will be signed soon.

However, uncertainties remain incredibly high. Additionally, some damage to consumer and business sentiment has already been done, which will likely drag on the economy.

Thus, investors wanting to reduce equity exposures could consider the current recovery as a window to do so.

Additionally, bond yields have moved back up, offering better entry levels to increase fixed-income allocations.

What to look out for next week

News from this weekend's meeting between U.S. and Chinese officials, which is due to take place in Geneva, will likely affect markets next week.

Given the scale of the differences between the sides, a major trade deal is unlikely. A more realistic scenario would be some form of de-escalation, possibly including lowering tariffs or carving out certain products.

Chart of the Week

CNN's fear and greed continued to improve very rapidly.

The index moved from a reading of 3 (Extreme Fear) in early April to 62 currently, which is in the "Greed" zone.

This reflects improvement in equity and credit markets. However, as mentioned above, uncertainties remain high, and the market's risk-on stance may be premature.

Thank you for reading. Please share the newsletter with those who may benefit.

Suvir Mukhi | Fincoaster.com

Disclaimer:

All content, information and opinions provided on Fincoaster are for informational and educational purposes only. Nothing contained herein is investment advice or recommendations. No guarantee is provided about the accuracy or completeness of the information provided. Readers should consult their financial advisers to ascertain the suitability of any investment.

Contributors to Fincoaster may, from time to time, have positions in any investments discussed.

Fincoaster is operated and managed by Envision Ventures Limited.