Fincoaster Weekly - 30 May 2025

U.S. equities rise on positive trade news; Lower inflation reading and Japan's moves to support its bond markets.

Happy Saturday,

Welcome to Fincoaster's weekly newsletter!

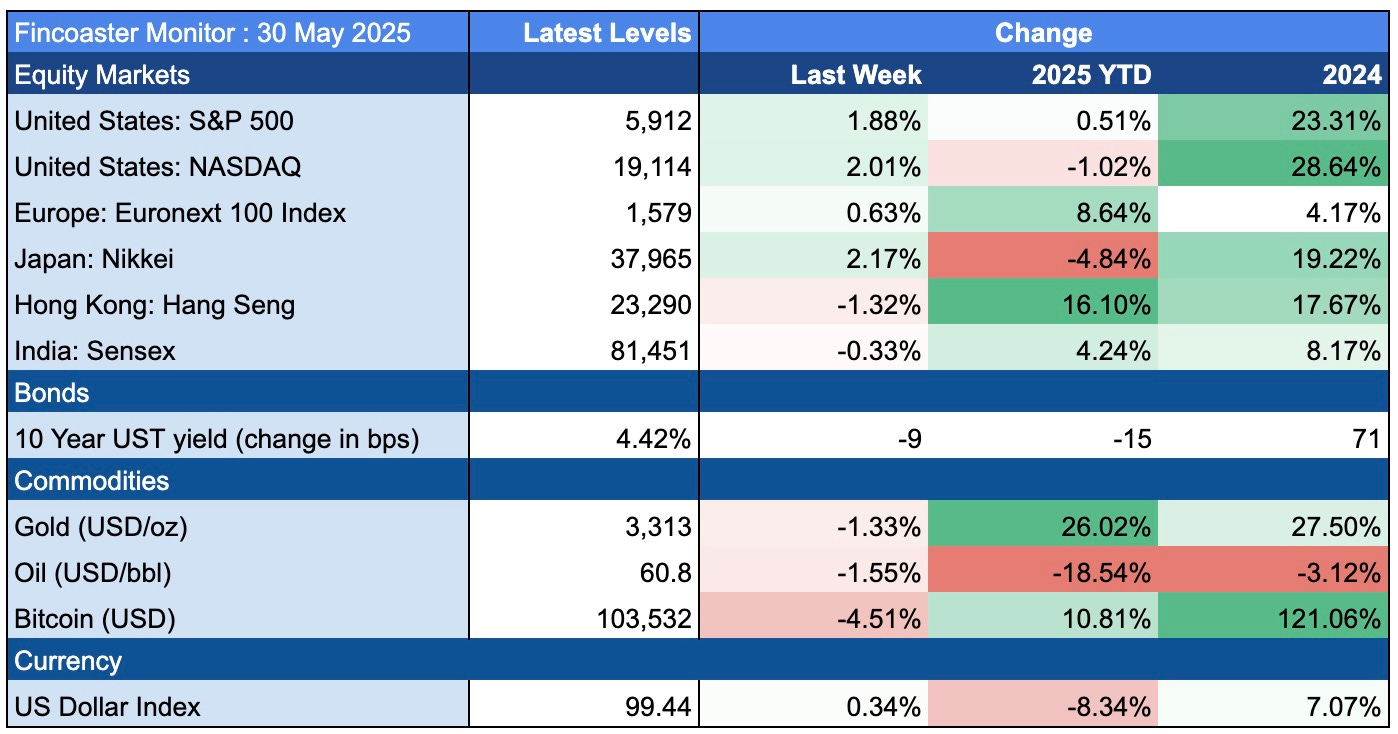

U.S. equity markets climbed this week amid positive trade news. Meanwhile, bond markets benefited from a lower inflation print and Japan's moves to stabilise its bond market.

Below, we examine the market action this week and discuss what to look for next week.

The Week That Was

U.S. equity markets were stronger this week, driven by positive trade news early in the week, a lower inflation print and supportive earnings from key companies.

The S&P 500 and NASDAQ climbed by 1.9% and 2.0%, respectively - capping a strong month and taking indexes closer to all-time highs seen in February.

Global markets were mixed, with the Nikkei higher, but Hong Kong and Indian markets seeing modest pull-backs.

Among the positive catalysts was an announcement from President Trump that the 50% tariff on imports from the E.U. would be delayed and that trade negotiations would be "fast-tracked."

There was further positivity when the U.S. Court of International Trade ruled that recently announced tariffs were not legal and would need to be put on hold. However, this excitement was short-lived, as the U.S. government appealed the ruling, allowing the tariffs to remain in place.

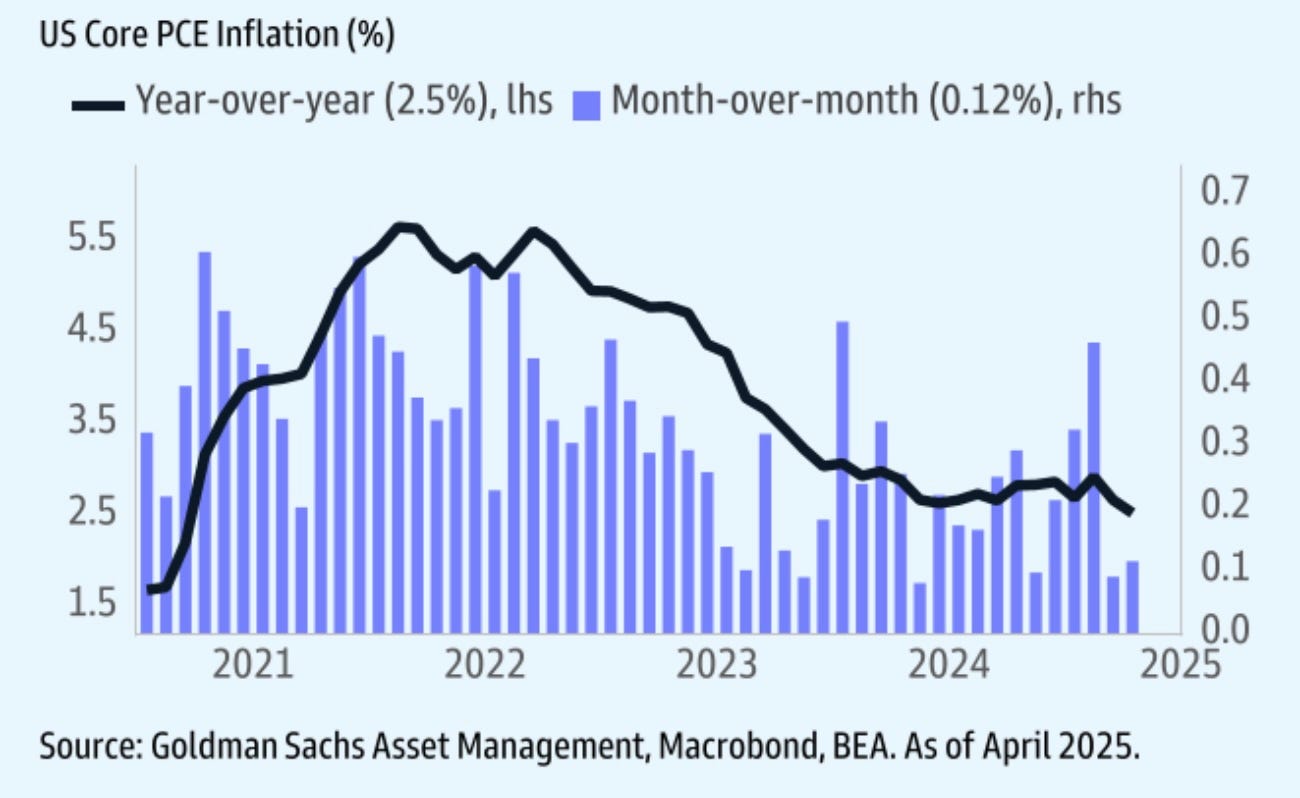

Meanwhile, a key economic reading for April showed inflation slowing down. The Federal Reserve's preferred measure of inflation, the core personal consumption expenditures index, rose by 2.5% in April, down from 2.7% in March. (see chart of the week below)

This news was welcomed by bond markets, with the yield on the 10-year U.S. Treasury bond declining by nine basis points (0.09 percentage points) during the week.

Global bond markets also benefited from news that Japan may reduce the issuance of longer-dated bonds to stabilise its fixed-income markets.

The U.S. dollar recovered slightly, with the U.S. dollar index climbing by 0.3% this week but remaining below the 100 level.

Gold and bitcoin were lower, declining by 1.3% and 4.5%, respectively.

What Does it All Mean?

With U.S. equity markets getting closer to all-time highs, investors should remind themselves of previous valuation concerns as well as the high level of uncertainty about trade policies:

At the end of the week, Treasury Secretary Scott Bessent said trade talks between the U.S. and China were "a bit stalled." At the same time, President Trump was reported to have said that China "violated" its preliminary agreement.

Moreover, the clock continues to tick on the 90-day pause in tariff implementation, and the process of signing trade agreements doesn't seem as smooth as the markets may be hoping for.

Thus, the market could be setting itself up for disappointment. It continues to make sense for investors overexposed to equity markets to use the recent recovery as an opportunity to rebalance their portfolios.

What to look out for next week

News on the trade front will likely remain the key driver of markets next week. Specifically, any developments between the U.S. and China, as well as the U.S. and the E.U., would be essential factors to monitor.

Chart of the Week

The chart below illustrates the trend in the U.S. core personal consumption expenditures index, the Federal Reserve's preferred measure of inflation.

Both on a year-over-year basis and month-over-month basis, inflation has been relatively contained in the last two months.

This would typically give the Fed room to ease interest rates - however, with the uncertainty of tariff impacts, the Fed can be expected to remain more cautious than usual.

Thank you for reading. Please share the newsletter with those who may benefit.

Suvir Mukhi | Fincoaster.com

Disclaimer:

All content, information and opinions provided on Fincoaster are for informational and educational purposes only. Nothing contained herein is investment advice or recommendations. No guarantee is provided about the accuracy or completeness of the information provided. Readers should consult their financial advisers to ascertain the suitability of any investment.

Contributors to Fincoaster may, from time to time, have positions in any investments discussed.

Fincoaster is operated and managed by Envision Ventures Limited.