Fincoaster Weekly - 28 March 2025

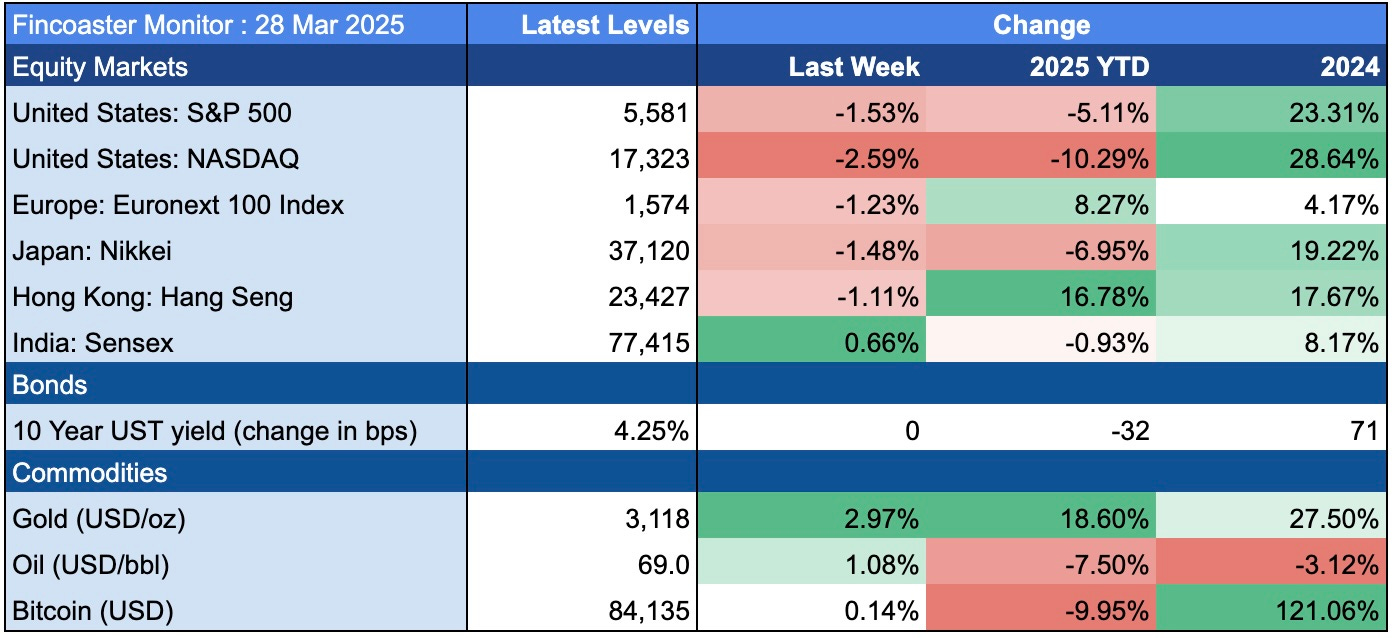

Lululemon adds to the list of companies warning about the U.S. economy; Gold, bonds and international equities continue to outperform U.S. stocks

Happy Saturday,

Welcome to Fincoaster's weekly newsletter!

This week, U.S. equities resumed their downtrend amid economic concerns. Lululemon became the latest company to warn about the state of the U.S. consumer.

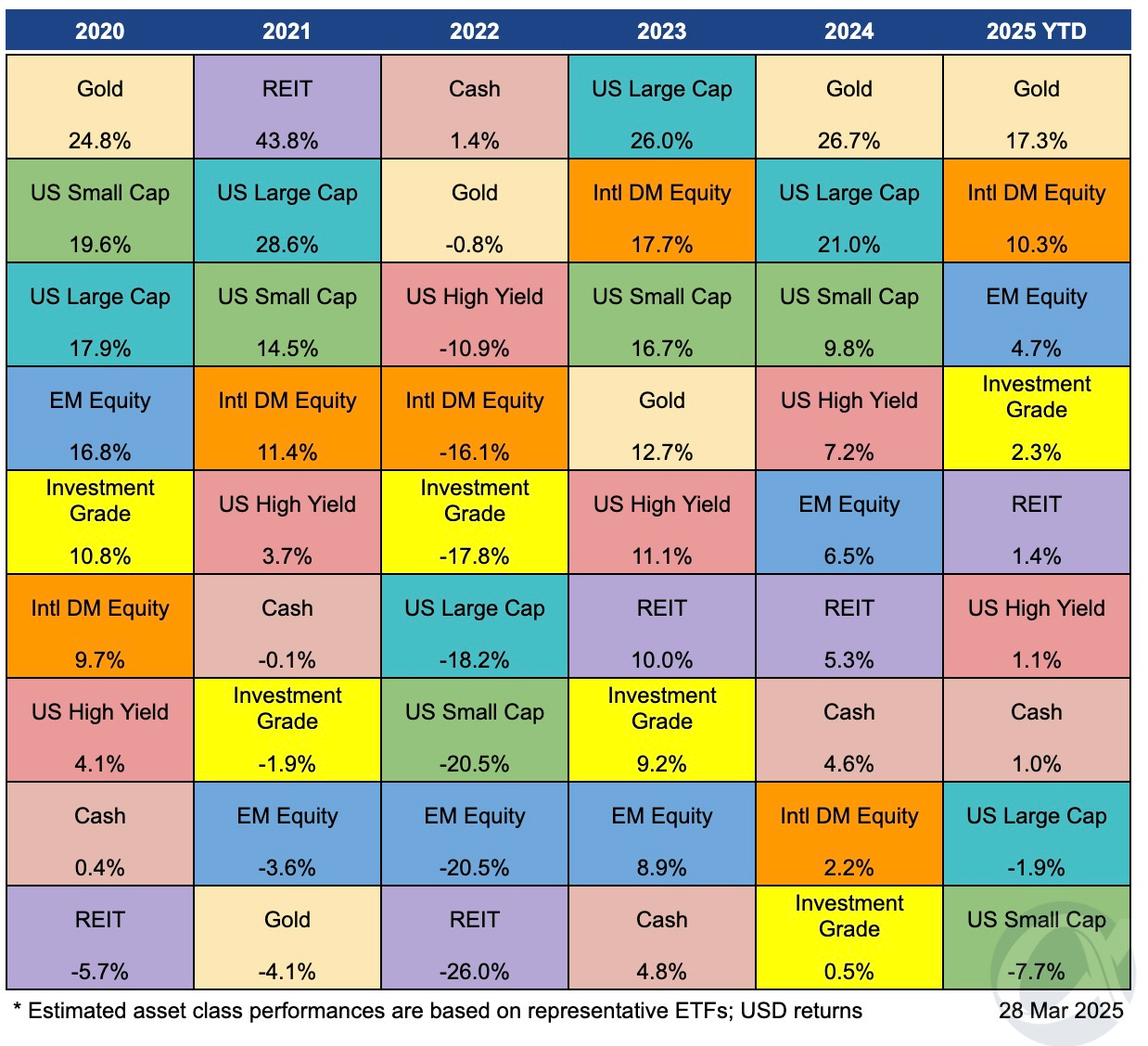

Other asset classes, including gold, income assets (bonds, REITs, cash) and international equities, continue to outperform - highlighting the importance of maintaining diversified exposures across asset classes. See our post on the importance of asset allocation.

Below, we examine market action this week, discuss what to look out for next week, and present two relevant charts.

The Week That Was

U.S. equity markets resumed their slide this week, with the S&P 500 down by 1.5% and the NASDAQ down by 2.6%.

The tech-heavy NASDAQ is now down more than 10% year-to-date and 14% from last year's highs.

Investors remain nervous over the escalating trade war and its potential impact on inflation. These factors negatively impact consumer and business confidence, increasing recessionary risks.

The latest salvo in the trade war was President Trump's declaration of a 25% tariff on all imported automobiles and auto parts.

The focus now turns to the broader reciprocal tariffs, which are expected to be announced next week.

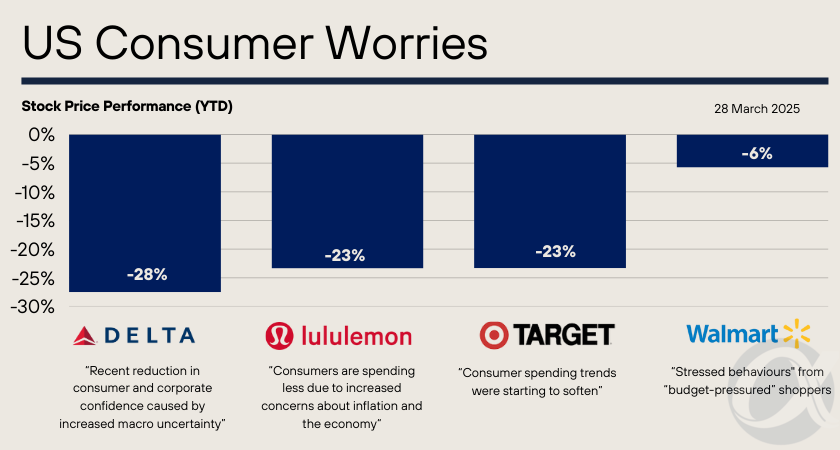

Athletic apparel retailer Lululemon has joined the list of companies flagging U.S. economic concerns. In addition to stagnant sales in the most recent quarter, CEO Calvin McDonald warned that "consumers are spending less due to increased concerns about inflation and the economy." He added, "This is manifesting itself into slower traffic across the industry in the U.S. in quarter one, which we are experiencing in our business as well."

This did not go down well with investors, with Lululemon's stock dropping by 14% on Friday.

Lululemon's warning, along with those of other consumer-facing companies, negatively reflects on the state of the U.S. retail sector. This is particularly important given that consumer spending remains the primary driver of U.S. economic activity, accounting for close to 70% of GDP.

See our chart of the week (1) for a selection of companies warning on the U.S. consumer and their recent stock price performances.

What Does it All Mean?

Increased economic uncertainty, brewing trade wars and heightened recessionary risks are weighing on U.S. equity markets. However, other asset classes, including gold, income assets (bonds, REITs, cash) and international equities, are outperforming.

This highlights the importance of asset allocation and maintaining diversified exposures across asset classes.

Appropriate asset allocation helps cushion overall portfolio volatility and allows investors to make tactical shifts in allocations to take advantage of opportunities.

See our chart of the week (2) for an updated asset class scorecard.

What to look out for next week

The focus will now be on President Trump's reciprocal tariffs, which are scheduled to begin on April 2. Under the plan, import tariffs will be applied, considering duties charged on American exports by each country.

The market will be tracking any last-minute updates, possible exclusions, or retaliatory moves from major trading partners.

Chart of the Week (1)

A series of U.S. companies have cautioned about the health of the U.S. consumer, which has weighed on their stock prices in recent weeks.

Tariff uncertainties, inflation concerns and high interest rates are causing consumers to hold back on spending.

Chart of the Week (2)

U.S. economic concerns and high valuations have pressured U.S. equity markets.

However, as seen below, other asset classes have performed well so far this year.

Thank you for reading. Please share the newsletter with those who may benefit.

Suvir Mukhi | Fincoaster.com

Disclaimer:

All content, information and opinions provided on Fincoaster are for informational and educational purposes only. Nothing contained herein is investment advice or recommendations. No guarantee is provided about the accuracy or completeness of the information provided. Readers should consult their financial advisers to ascertain the suitability of any investment.

Contributors to Fincoaster may, from time to time, have positions in any investments discussed.

Fincoaster is operated and managed by Envision Ventures Limited.