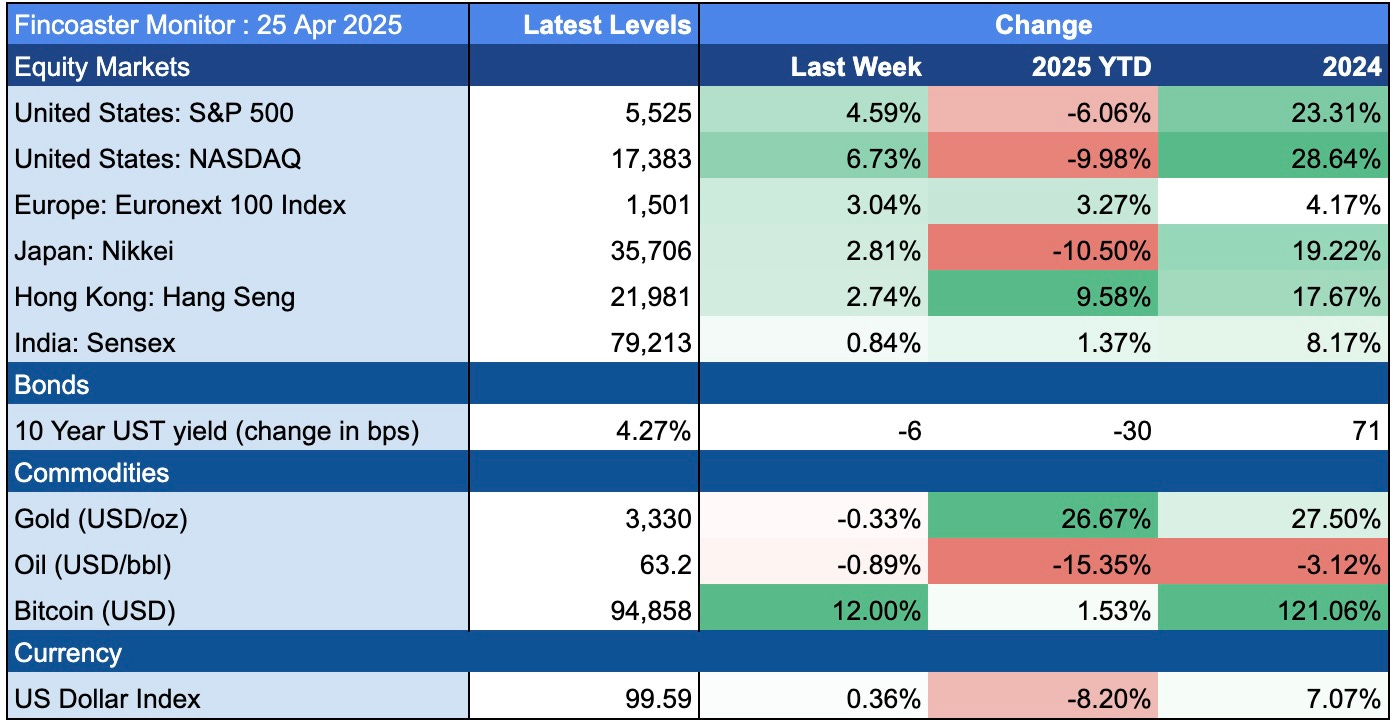

Fincoaster Weekly - 25 April 2025

U.S. equities recover on trade deal hopes and Trump's denial that he would fire Powell; Is complacency creeping back into markets?

Happy Saturday,

Welcome to Fincoaster's weekly newsletter!

This week, U.S. equity markets rebounded on hopes of easing trade tensions and Trump's denial that he would fire Federal Reserve Chair Jerome Powell.

With the S&P 500 recovering over 80% of its losses following the tariff announcement and a sharp drop in implied volatility, markets could be getting complacent.

Below, we examine the market action this week, discuss what to look for next week and highlight two relevant charts.

The Week That Was

U.S. equity markets rallied this week, with the S&P 500 and NASDAQ higher by 4.6% and 6.7%, respectively.

The strong rally was driven by hopes for an easing of global trade tensions and President Trump's assurances that he would not fire Federal Reserve chairman Jerome Powell before his term expires.

On trade, Trump said tariffs on goods from China were likely to come down substantially, and Treasury Secretary Scott Bessent told investors that de-escalation was likely.

Meanwhile, fears that Trump would fire Jerome Powell due to his refusal to cut rates as fast as Trump would like were put to rest. Likely in reaction to market moves, Trump said, "I have no intention of firing him."

The U.S. dollar also recovered from its mid-week lows. However, the dollar index remains below 100, down over 8% for the year.

Investors, who remain overweight U.S. assets (currency, bonds, and equities), are likely to continue looking to diversify internationally, keeping the U.S. dollar under pressure.

Bond yields continued to decline (and prices climbed), with the 10-year U.S. Treasury bond yield lower by six basis points (0.06 percentage points).

Despite potential easing in trade tensions, the hit to business and consumer confidence will likely weigh on global economies. Thus, the Federal Reserve will likely deliver a rate cut later in the year.

What Does it All Mean?

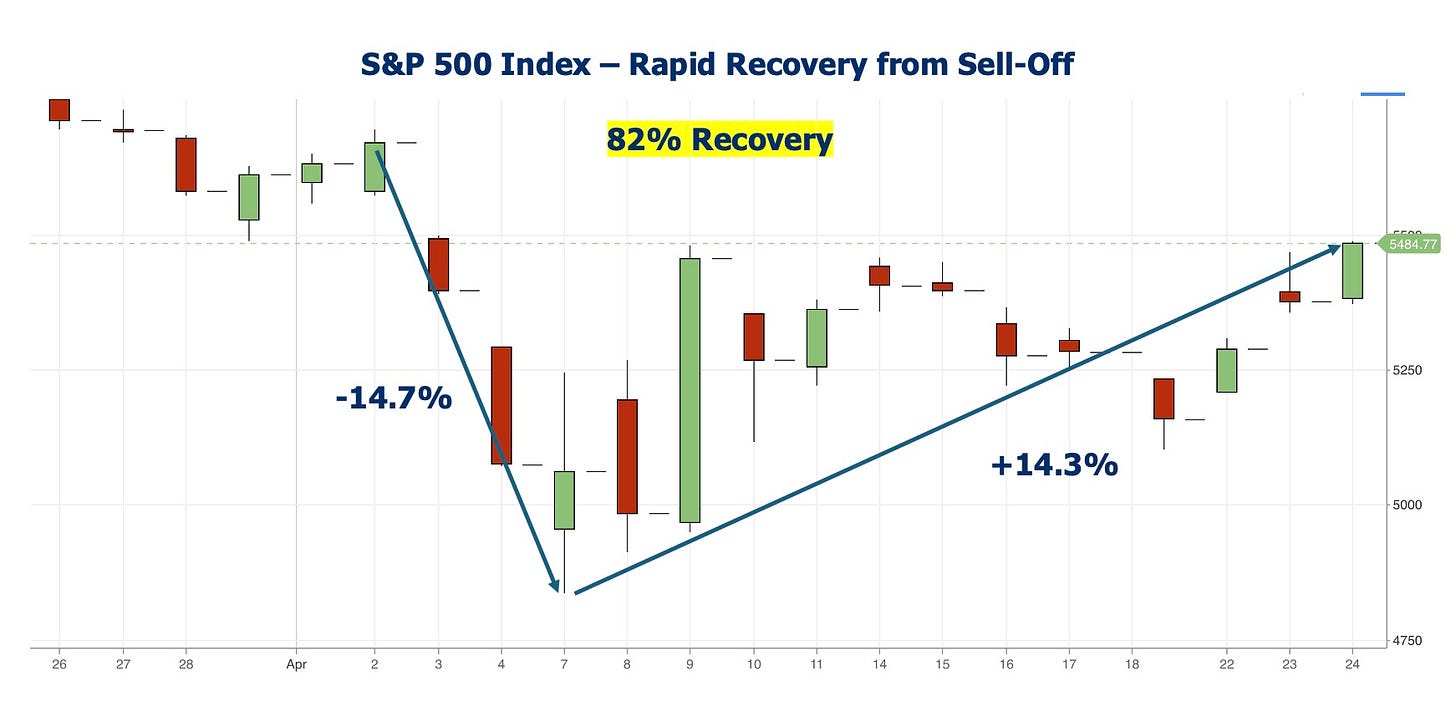

The recovery in equity markets has been fueled by a series of tariff step-backs, including a 90-day pause and the exclusion of certain electronics. In addition, the market is also banking on a reduction in tariff rates for Chinese imports.

The original tariff announcements were made on April 2 (liberation day) and resulted in panic selling, with the S&P 500 down as much as 14.7% at its low point on April 7.

However, the market has recovered 82% of the loss (see chart of the week (1) below).

Investors overly exposed to equities may consider using the current bounce to re-balance their portfolios and reduce equity exposures.

Even if tariffs are partially rolled back, hits to consumer and business confidence and trade disruptions will take a toll on the global economy. (See our post on asset allocation)

Another reflection of the recovery in markets is the decline in the VIX index (see chart of the week (2) below).

The index has dropped from over 50 following the tariff announcement to 26.

The lower VIX means the market is pricing-in less volatility into option markets and could be getting complacent relative to the high level of prevailing uncertainties.

What to look out for next week

The market will continue to be driven by developments on the trade front, especially any news on trade deals between U.S. and its trading partners.

Chart of the Week (1)

Markets have staged an impressive rebound from their April 7 lows.

The S&P 500 has recouped 82% of its losses following the tariff announcements on April 2.

Chart of the Week (2)

The recover in markets is also reflected in the normalisation of the VIX index.

The VIX index measures the implied volatility priced into option markets.

Given that economic and earning uncertainties remain high, it could be a case of complacency creeping back in to markets, leaving them vulnerable to disappointments.

Thank you for reading. Please share the newsletter with those who may benefit.

Suvir Mukhi | Fincoaster.com

Disclaimer:

All content, information and opinions provided on Fincoaster are for informational and educational purposes only. Nothing contained herein is investment advice or recommendations. No guarantee is provided about the accuracy or completeness of the information provided. Readers should consult their financial advisers to ascertain the suitability of any investment.

Contributors to Fincoaster may, from time to time, have positions in any investments discussed.

Fincoaster is operated and managed by Envision Ventures Limited.