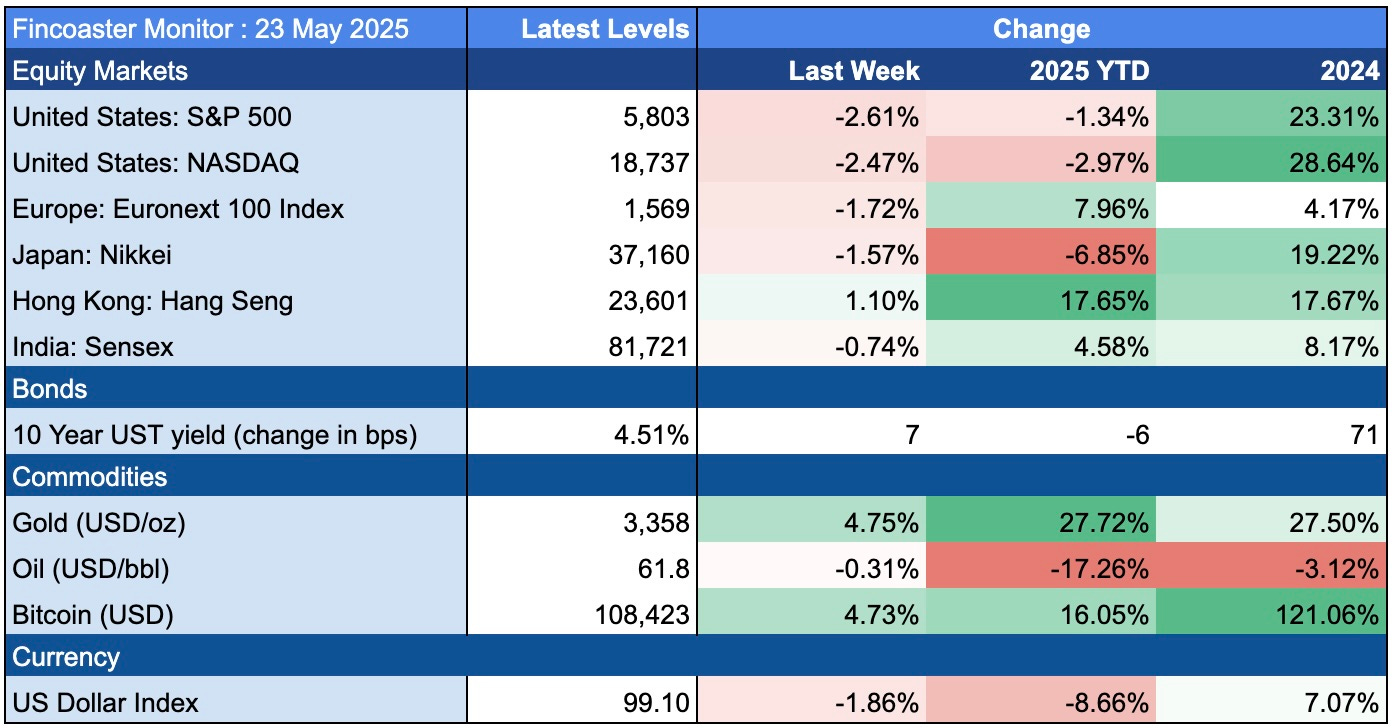

Fincoaster Weekly - 23 May 2025

U.S. equity decline on rating downgrade and renewed trade tensions; Volatility in bond markets needs to be monitored closely

Happy Saturday,

Welcome to Fincoaster's weekly newsletter!

Global equity markets were lower this week, with the U.S. rating downgrade and renewed trade tensions weighing on sentiment.

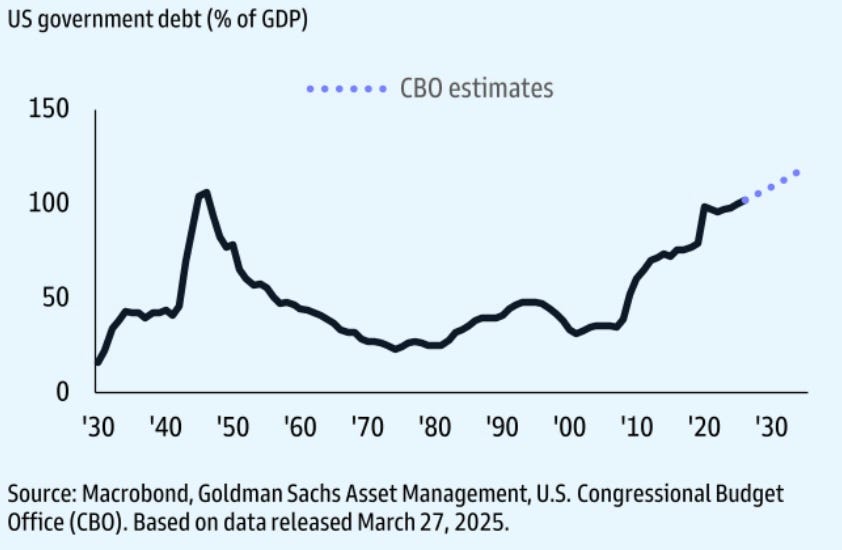

Bond markets were also under pressure as the U.S. rating downgrade reminded markets about the structural issue of high debt levels in the U.S. and other developed economies (see chart of the week below).

Below, we examine the market action this week and discuss what to look for next week.

The Week That Was

Global stock markets were lower this week as the U.S. rating downgrade and renewed trade tensions weighed on sentiment.

The S&P 500 and NASDAQ dropped by 2.6% and 2.4%, respectively - partly reversing some of the previous week's gains.

Moody's downgrade of the U.S. sovereign rating at the end of last week was a key driver of market volatility.

The downgrade reminded markets of the structural issue of high and rising debt levels in the U.S. and other developed markets.

As a result, global bond yields climbed, with the U.S. 10-year Treasury bond rising to 4.62% mid-week before recovering to 4.51%.

Rising bond yields can pressure equity markets in several ways:

Higher financing costs for corporates → Pressure on earnings

High borrowing costs for consumers → Reduced disposable income → Pressure on earnings for consumer companies

Higher bond yields increase the relative attractiveness of bonds over equities

Higher discount rates in valuing future earnings of companies → lower earnings multiples and stock prices

Increased macro risks + government bond re-financing issues → lower market multiples and potential of fear re-entering markets

The other major driver of markets this week was an increase in trade tensions with President Trump warning of a 50% tariff on E.U. products and a 25% tax on non-U.S.-made iPhones.

As mentioned last week, global trade uncertainties remain high despite the temporary trade truce between the U.S. and China.

The U.S. rating downgrade and trade uncertainties caused the U.S. dollar to decline sharply (-2.0%), benefiting other currencies, gold (+4.8%) and bitcoin (+4.7%).

What Does it All Mean?

The latest tariff warnings from President Trump remind us that trade uncertainties remain very high. Current tariff delays are temporary, and few trade agreements have been finalized.

It makes sense for investors overexposed to equity markets to use the recent recovery to rebalance their portfolios.

What to look out for next week

It will be important to watch closely in the coming weeks whether bond markets can stabilize independently or if there is any official support for them.

For the reasons mentioned above, continued bond weakness can destabilize financial markets.

Chart of the Week

The chart below shows how persistent government deficits in the U.S. have led to increasing debt levels as a percentage of GDP.

This is a key driver of the recent downgrade by Moody's

A similar picture exists for many developed economies and remains a structural risk to the global economy.

Thank you for reading. Please share the newsletter with those who may benefit.

Suvir Mukhi | Fincoaster.com

Disclaimer:

All content, information and opinions provided on Fincoaster are for informational and educational purposes only. Nothing contained herein is investment advice or recommendations. No guarantee is provided about the accuracy or completeness of the information provided. Readers should consult their financial advisers to ascertain the suitability of any investment.

Contributors to Fincoaster may, from time to time, have positions in any investments discussed.

Fincoaster is operated and managed by Envision Ventures Limited.