Fincoaster Weekly - 21 March 2025

Federal Reserve Kept Rates Unchanged; Sees More Rate Cuts Later in the Year

Happy Saturday,

Welcome to Fincoaster's weekly newsletter!

This week, the Federal Reserve left interest rates unchanged but projected two cuts later in the year. Below, we look at the details and what this could mean for your portfolio.

We also dug into the 'Mar-A-Lago' Accord during the week. Read our post about how this possible grand bargain named after Donald Trump's Florida resort could significantly weaken the U.S. dollar to address global trade imbalances.

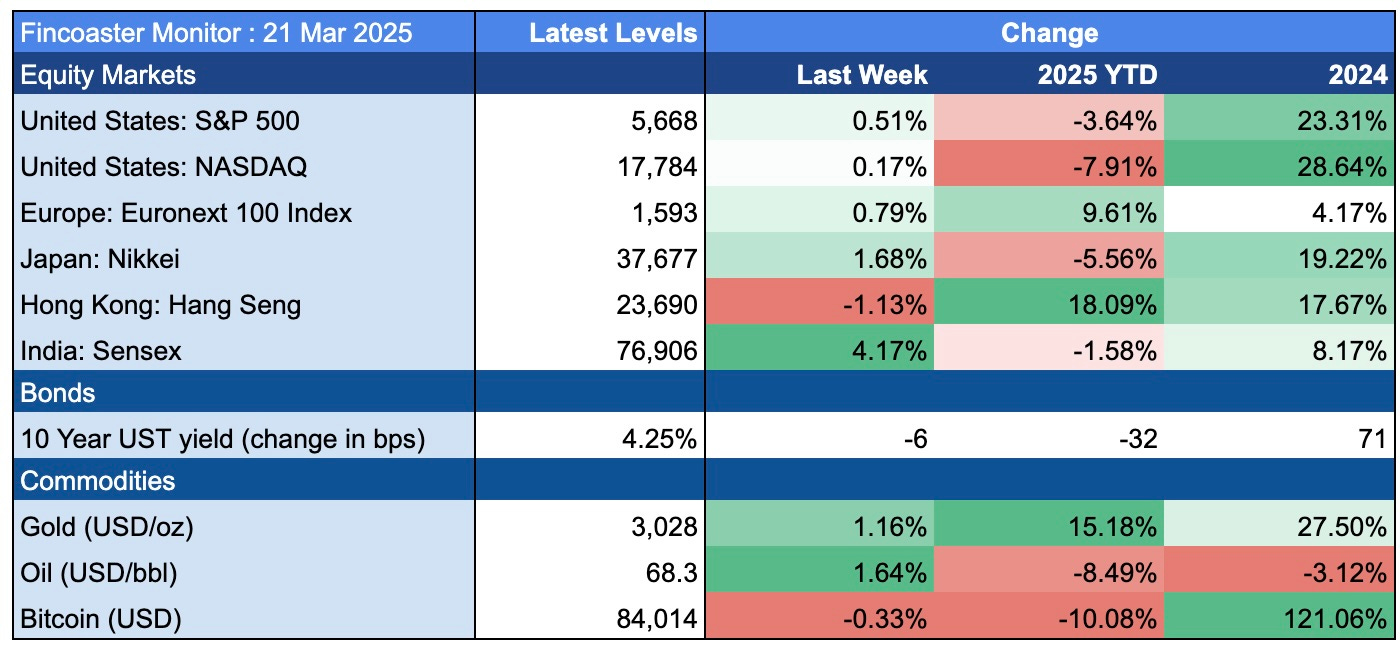

The Week That Was

This week, U.S. equity markets traded in a narrow range, focusing mainly on the Federal Reserve meeting. In international markets, Hong Kong saw some profit taking, while India rallied on bargain hunting and a return of foreign investors.

Bond yields continued to drift lower, with the 10-year U.S. Treasury bond yield dropping by six basis points (0.06 percentage points) to 4.25%. Investors were likely encouraged to buy bonds amid growing recessionary risks, equity volatility, and the potential for future interest rate cuts (see below).

Gold held above US$3,000/oz and continues to draw investor interest amid continued central bank buying.

The week's main event was the Federal Reserve meeting, at which interest rates were left unchanged—as widely expected.

For the second time, the Federal Funds Rate was maintained at 4.25%–4.50% as the central bank took a wait-and-see approach.

After cutting interest rates by 100 basis points (1 percentage point) in 2024, the Fed has held steady rates recently as it assesses the economy's trajectory and inflation outlook.

This is especially relevant amid the wide range of policy changes, including trade, immigration, and government spending, that could have significant economic impacts.

The Fed lowered its outlook for the U.S. economy, with the median expectation for real economic growth in 2025 reduced to 1.7% (previously 2.1%). Meanwhile, inflation expectations were adjusted higher.

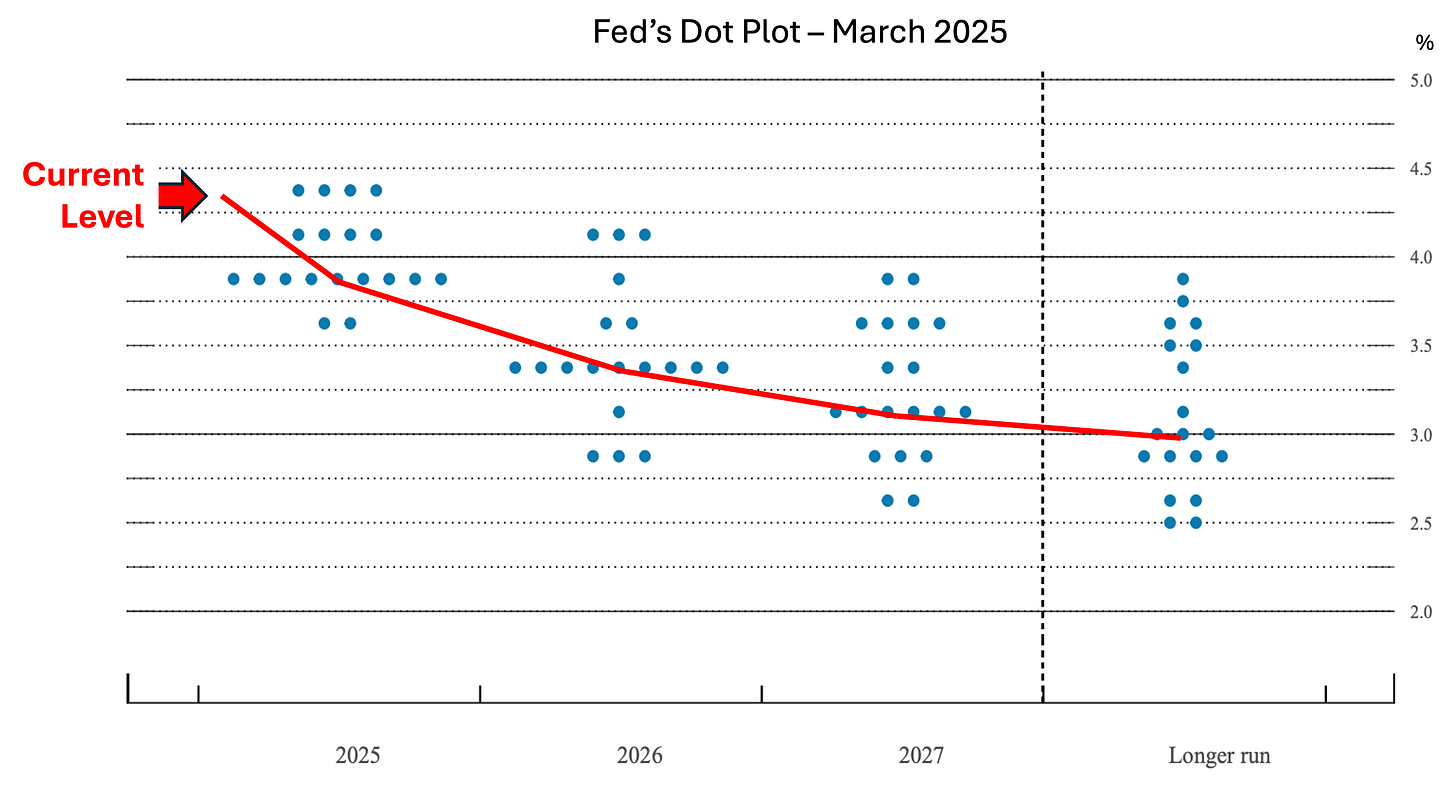

The Federal Reserve also provided an updated 'dot plot' showing the expected path of interest rates over the next few years. The median expectation of the Fed committee members is for two rate cuts during 2025. See the 'dot plot' in our chart of the week section below.

What does it all mean? The Federal Reserve is guiding for more rate cuts later this year. However, this will depend on how economic growth pans out and what happens to inflation amid additional import tariffs.

Additional rate cuts will lower deposit rates and the expected return on short-tenor instruments such as money market funds.

Income-dependent investors could consider longer-tenor bonds to lock-in rates, but they need to be aware of potential price volatility risks stemming from movements in interest rates and credit spreads (for corporate bonds).

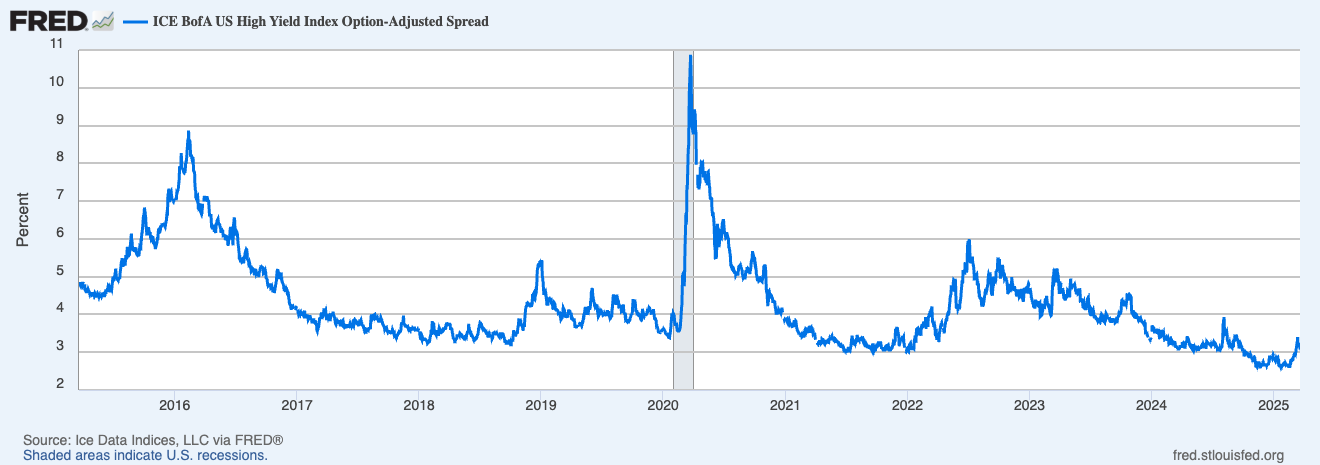

Our second chart of the week below looks at the historical trend of credit spreads for non-investment grade-rated bonds.

What to look out for next week

U.S. trade tariff developments will remain the key focus. President Trump has highlighted that reciprocal tariffs will kick in on April 2. Under the plan, import tariffs will be applied, considering duties charged on American exports by each country.

This could be a further escalation in the ongoing global trade war.

Markets will keenly follow any headlines related to these reciprocal tariffs before the implementation date.

On Friday, President Trump seemed to offer an olive branch, saying there would be "flexibility" in the reciprocal tariff plan.

Chart of the Week (1)

The below 'Dot Plot' from the Federal Reserve shows the expected interest rate path for each Federal Open Market Committee (FOMC) member.

The current rate of 4.25%–4.50% is indicated with the red arrow.

Each blue dot represents where FOMC members see the rate at the end of 2025, 2026 and 2027, while the red line indicates the median of the forecasts.

As can be seen, the median forecast is for two 25-basis-point reductions in 2025 and further cuts in 2026 and 2027.

Chart of the Week (2)

The chart below captures the additional yield available on non-investment-grade rated corporate bonds over U.S. government securities (i.e., the credit spread).

The credit spread typically increases significantly in recessionary periods and other times of market uncertainty. Rising credit spreads reflect higher default risks and result in lower bond prices.

Given increasing economic uncertainties credit spreads have started to rise recently. However, levels remain low by historical standards—hence, investors need to be mindful of further widening risks.

Thank you for reading. Please share the newsletter with those whom may benefit.

Suvir Mukhi | Fincoaster.com

Disclaimer:

All content, information and opinions provided on Fincoaster are for informational and educational purposes only. Nothing contained herein is investment advice or recommendations. No guarantee is provided about the accuracy or completeness of the information provided. Readers should consult their financial advisers to ascertain the suitability of any investment.

Contributors to Fincoaster may, from time to time, have positions in any investments discussed.

Fincoaster is operated and managed by Envision Ventures Limited.