Fincoaster Weekly - 2 May 2025

U.S. equity markets rallied this week and have fully recovered from the tariff announcement; With plenty of uncertainties remaining, the market might be letting its guard down prematurely.

Happy Saturday,

Welcome to Fincoaster's weekly newsletter!

This week, equity markets continued to rally on hopes of possible trade deals. Markets have now fully recovering from the April 2 tariff announcement — this is possibly a case of the market letting its guard down prematurely.

Below, we examine the market action this week, discuss what to look for next week and highlight two relevant charts.

The Week That Was

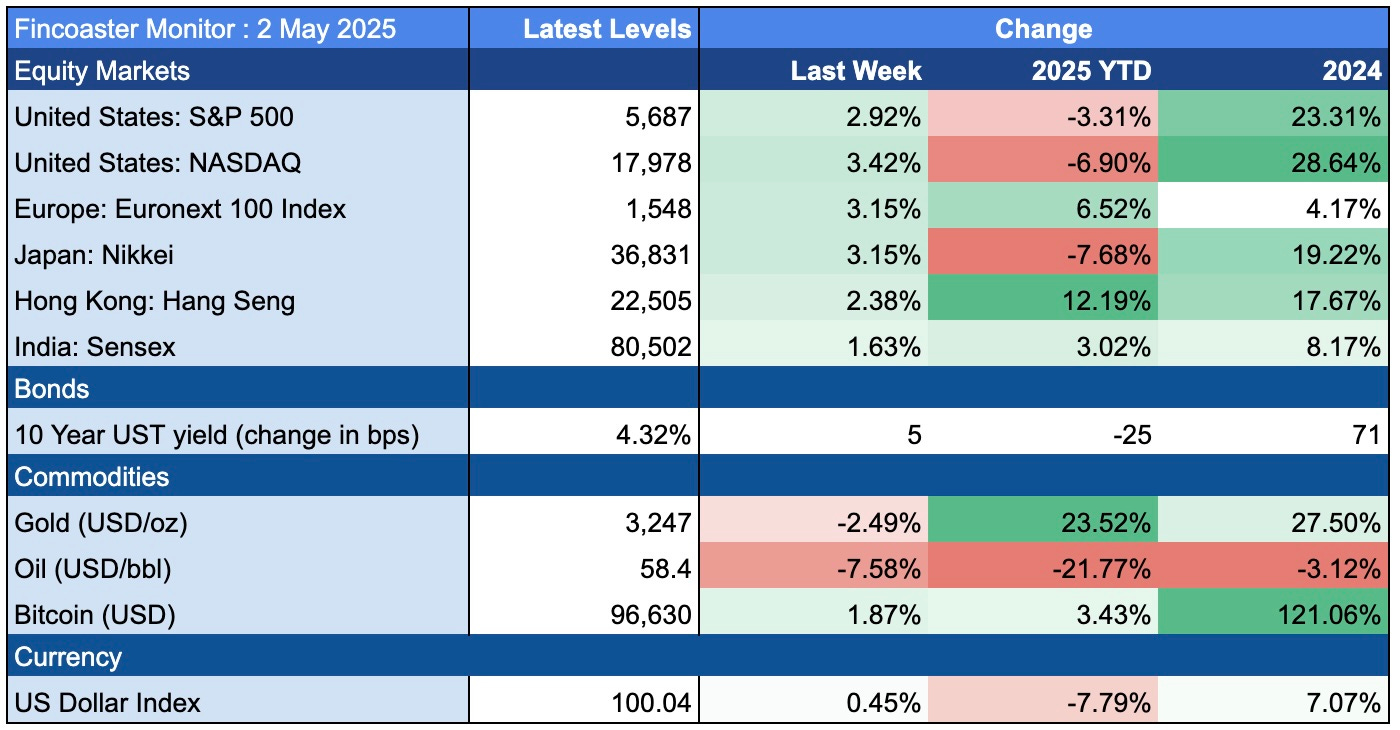

It was another strong week for equity markets, with the S&P 500 and NASDAQ higher by 2.9% and 3.4%, respectively. Global markets also performed well.

Potential trade talks between the U.S. and China buoyed equity markets. China also exempted some U.S. goods from import tariffs. On the earnings front, first-quarter results were not as bad as feared.

News that the U.S. economy contracted in the first quarter was largely brushed aside, as it was solely due to a surge in imports prior to tariffs kicking in (see chart of the week (2) below).

The S&P 500 and NASDAQ have now fully recovered losses since the April 2 tariff announcement.

Bond yields climbed slightly during the week amid positive risk sentiment and stronger-than-expected April employment data in the U.S.

The U.S. dollar continued to recover, with the U.S. dollar index reclaiming the 100 level.

What Does it All Mean?

The strong recovery in equity markets contrasts with the still high level of uncertainties regarding trade tariffs and risks to the global economy.

The clock is ticking on the 90-day pause in retaliatory tariffs, yet no trade deals have been announced. Further, hopes for U.S. and China trade talks are only based on comments that both sides are open to discussions. Scheduling a meeting and reaching any meaningful deal still seem distant goals.

Equity markets may have jumped the gun, and priced in high probabilities of positive outcomes.

Thus, investors overly exposed to equity markets may use the current recovery to re-balance their portfolios.

What to look out for next week

Developments on trade will continue to take centre stage. Progress on the U.S. signing trade agreements with key trading partners will be an important milestone.

Additionally, the Federal Reserve will meet next week. It is widely expected that rates will remain unchanged. However, markets will closely track Powell's press conference for hints on future rate cuts.

Chart of the Week (1)

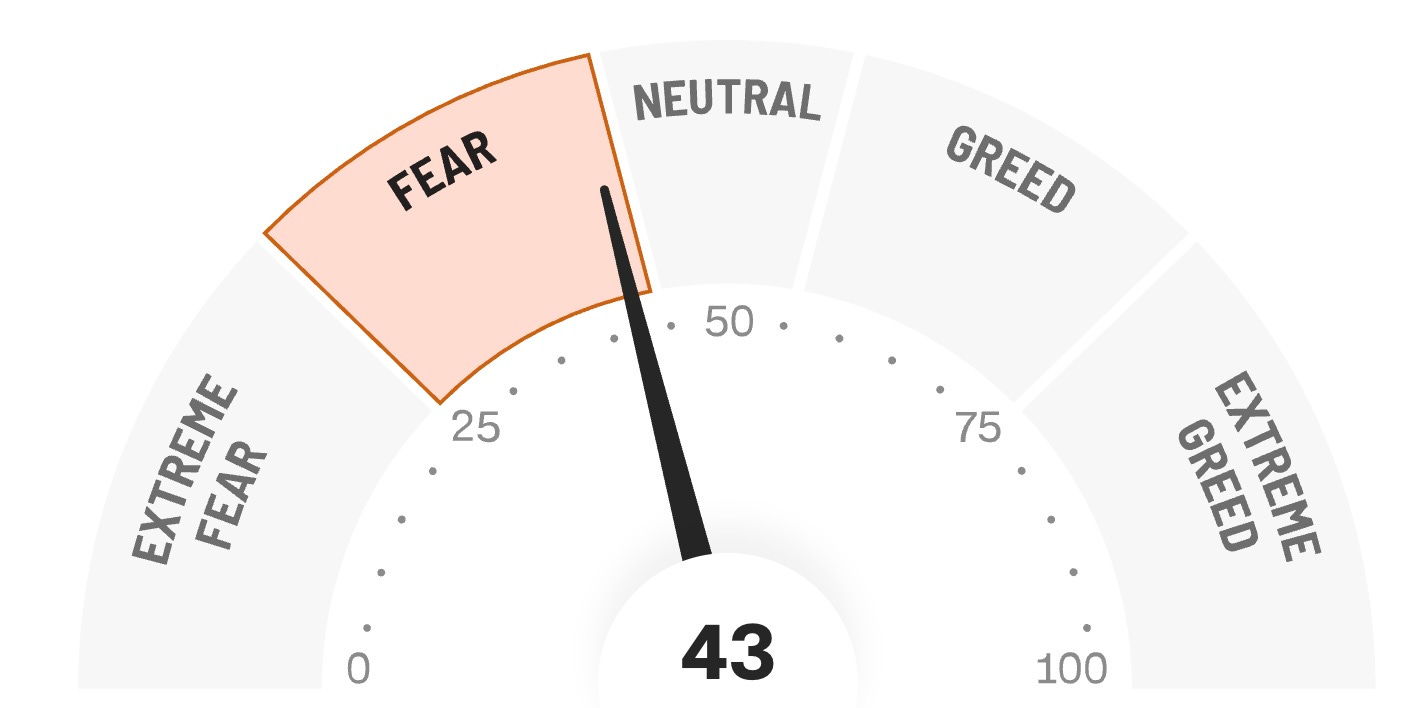

CNN's fear and greed index has quickly moved from a reading of 3 (Extreme Fear) in early April to 43 currently.

A reading of 43 is almost out of the 'Fear' zone — and back to a more neutral reading.

Given the high level of uncertainties prevailing — the market may be letting its guard down prematurely.

Chart of the Week (2)

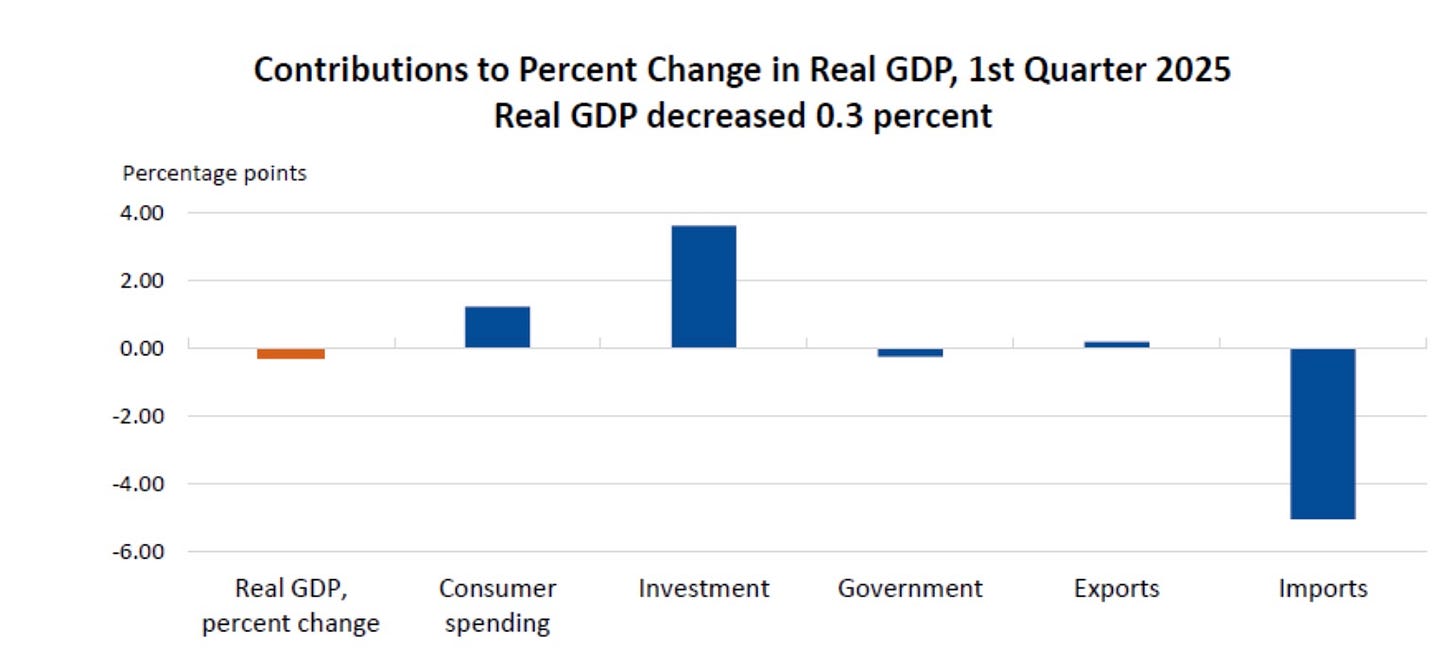

This week, the U.S. Bureau of Economic Analysis announced that the U.S. economy contracted in the first quarter of 2025.

Specifically, real gross domestic product (GDP) decreased at an annual rate of 0.3% during the quarter.

The market digested this economic contraction well because the details showed that the sole reason for the contraction was a surge in imports, which are subtracted from GDP (see chart below).

The spike in imports likely reflected advance purchases ahead of tariff implementation. Consumer spending and investment activity were positive, reflecting healthy economic activity in the quarter.

However, things could get less sanguine in the coming quarters.

Thank you for reading. Please share the newsletter with those who may benefit.

Suvir Mukhi | Fincoaster.com

Disclaimer:

All content, information and opinions provided on Fincoaster are for informational and educational purposes only. Nothing contained herein is investment advice or recommendations. No guarantee is provided about the accuracy or completeness of the information provided. Readers should consult their financial advisers to ascertain the suitability of any investment.

Contributors to Fincoaster may, from time to time, have positions in any investments discussed.

Fincoaster is operated and managed by Envision Ventures Limited.