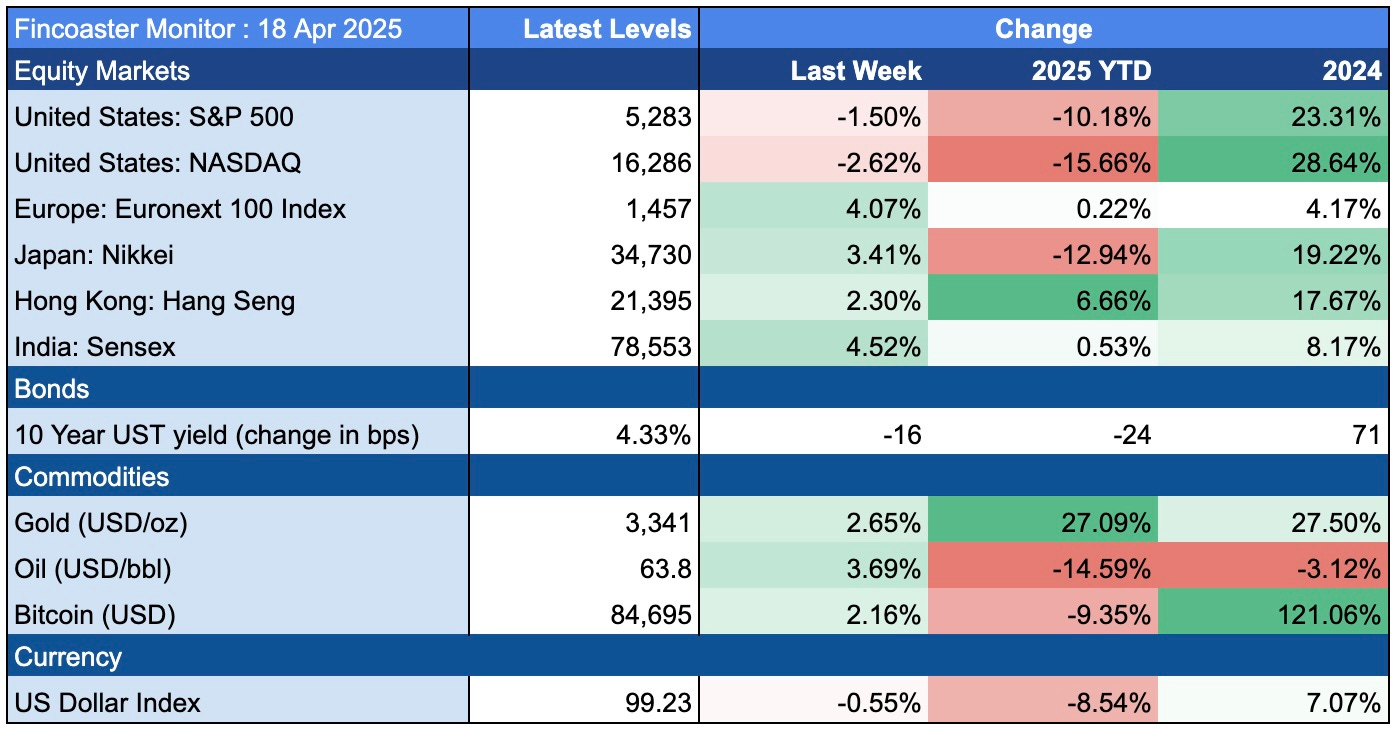

Fincoaster Weekly - 18 April 2025

U.S. equities decline on tariff uncertainty and warnings from Powell; International markets outperform as more investors look outside the U.S.

Happy Saturday,

Welcome to Fincoaster's weekly newsletter!

This week, U.S. equity markets gave back some gains amid trade policy uncertainties and economic warnings from Federal Reserve Chair Jerome Powell.

International equities continued outperforming as investors looked to diversify away from U.S. assets. This was reflected in further weakness in the U.S. dollar.

Below, we examine the week's events and what to expect next week. Our weekly charts are from Bank of America's Global Fund Manager Survey and provide insight into how large fund managers are thinking.

The Week That Was

U.S. equity markets gave back some of the previous week's gains amid trade policy uncertainty and economic warnings from Jerome Powell.

The market started the week with high hopes on news that smartphones and laptops would be excluded from reciprocal tariffs. However, it was soon clarified that this was only a temporary arrangement - dampening the sentiment.

Comments from Federal Reserve Chair Jerome Powell also weighed on the market. Powell warned that the tariff levels announced, which were higher than expected, "could inflict significant economic damage." He painted a scenario of weaker growth and higher inflation.

Markets outside the U.S. continued to outperform due to domestic factors and a continued trend of diversification away from U.S. assets.

As previously noted, global investors have significantly increased allocation to U.S. assets (currency, bonds and equities) since the global financial crisis.

Investors have been attracted to U.S. markets amid political and economic stability as well as the strong performance of U.S. corporations.

This resulted in high valuations for many large U.S. technology companies, and investors are now questioning the justification of these valuations and are seeing better value in international markets.

The shift away from U.S. assets was also reflected in further weakening in the greenback. The U.S. dollar index dropped an additional 0.5% and is now down 8.5% this year.

Bond yields fell, and prices climbed during the week as technical selling abated. Recent bond auctions were also supportive.

The 10-year U.S. Treasury bond yield declined by 16 basis points (0.16 percentage points) to 4.33%.

Despite Jerome Powell's comments, it is still likely that the Federal Reserve will cut rates later in the year, especially if the economy stalls - which could be positive for bond markets. (see chart of the week (2) below)

What Does it All Mean?

The pause in reciprocal tariffs and the temporary exclusion of certain electronic items offers a window for trade deals to be struck or for changes to be made in the overall tariff framework.

However, trade uncertainty and financial market volatility have already significantly dented consumer and business sentiment. Thus, a serious growth slowdown or recession remains very likely.

Additionally, the risk of a much more severe economic crisis still exists if trade deals prove elusive and tariffs are implemented in full force.

Thus, whilst investors should look for opportunities amid the volatility, risk management remains crucial in protecting portfolios.

Portfolio diversification, including appropriate asset allocation, can help contain volatility. Asset classes such as gold and bonds can cushion equity volatility. (See our post on asset allocation)

What to look out for next week

President Trump has indicated that several countries are close to signing trade deals with the U.S. Any news on this front could positively impact markets.

Key companies, including Tesla (TSLA) and Alphabet (GOOGL), will report first-quarter earnings next week. Investors will closely monitor forward guidance for a real-time view of the business environment.

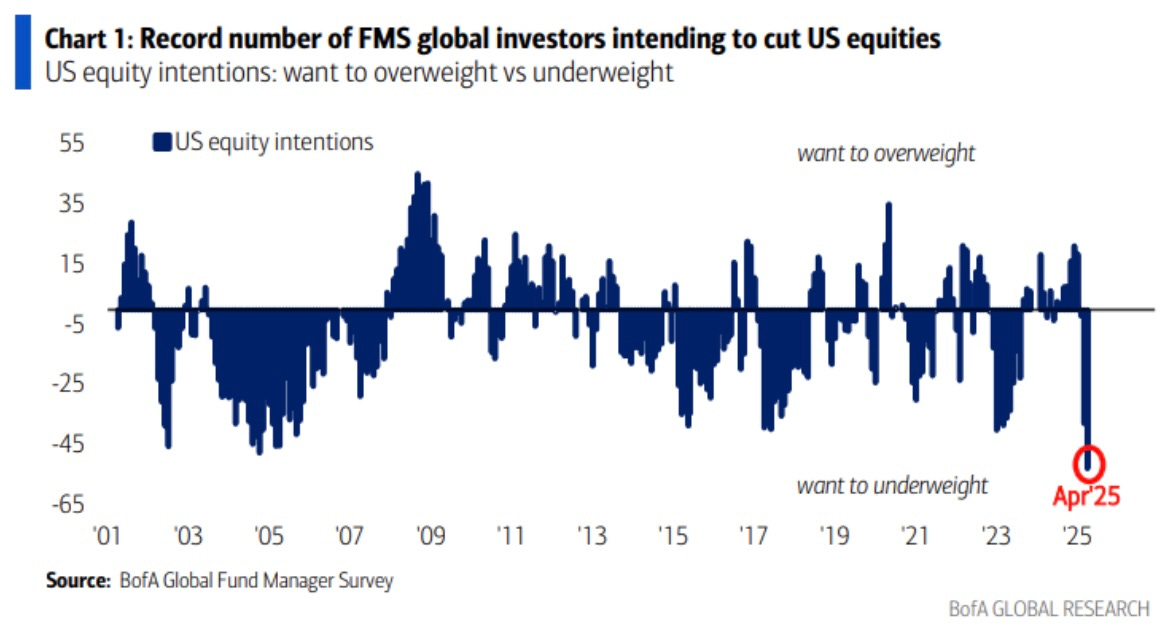

Chart of the Week (1)

The latest Bank of America Global Fund Manager Survey showed that a record number of investment professionals plan to reduce U.S. equity exposures.

It is important to note that some of this may already be reflected in price action - thus investors should not rely solely on these data points to make drastic changes to their allocations.

In fact, such overall bearishness may lead to technical bounces — and investors could use such opportunities to make adjustments if needed.

At the same time, longer-term investors may actually find attractive opportunities amid the volatility.

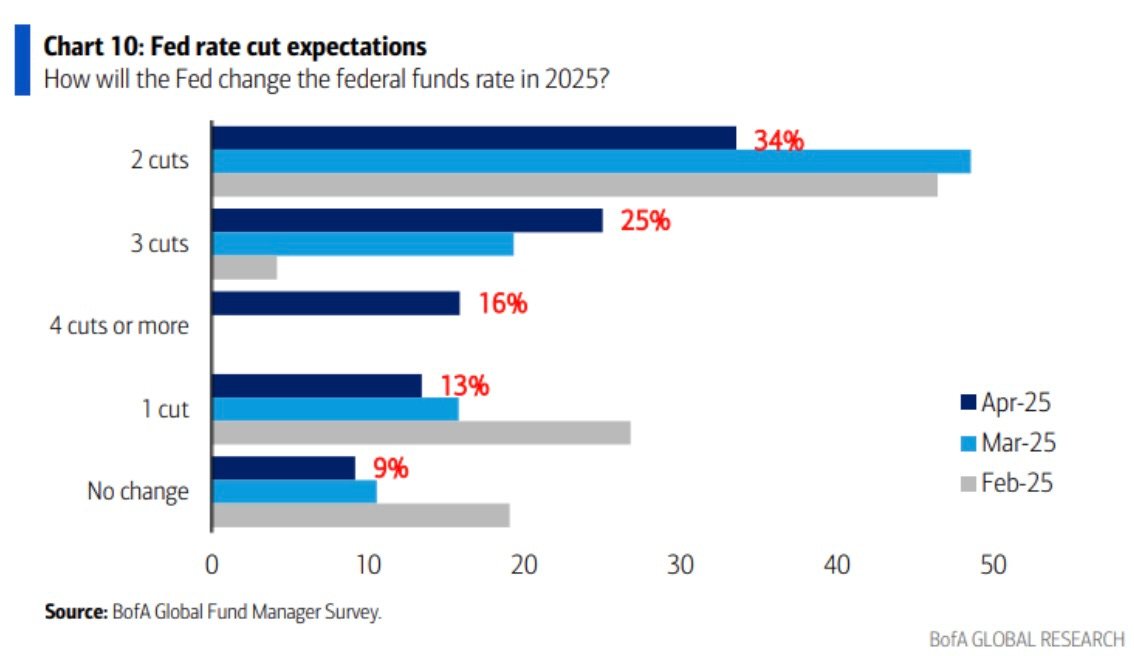

Chart of the Week (2)

The below chart is from the same Bank of America Global Fund Manager Survey.

It shows that over the past three months, investors have been increasing their expectations of rate cuts in 2025, with a growing crowd looking for three or four cuts this year.

Thank you for reading. Please share the newsletter with those who may benefit.

Suvir Mukhi | Fincoaster.com

Disclaimer:

All content, information and opinions provided on Fincoaster are for informational and educational purposes only. Nothing contained herein is investment advice or recommendations. No guarantee is provided about the accuracy or completeness of the information provided. Readers should consult their financial advisers to ascertain the suitability of any investment.

Contributors to Fincoaster may, from time to time, have positions in any investments discussed.

Fincoaster is operated and managed by Envision Ventures Limited.