Fincoaster Weekly - 16 May 2025

U.S. equity markets jumped on the U.S.-China trade agreement; Moody's U.S. downgrade is likely to impact markets next week.

Happy Saturday,

Welcome to Fincoaster's weekly newsletter!

Global equity markets rallied strongly this week following news that the U.S. and China would slash tariffs for 90 days, providing a window for further negotiations.

After the markets closed for the week, Moody's said it downgraded the U.S. sovereign credit rating to Aa1 from Aaa.

Below, we examine the market action this week and discuss what to look for next week.

The Week That Was

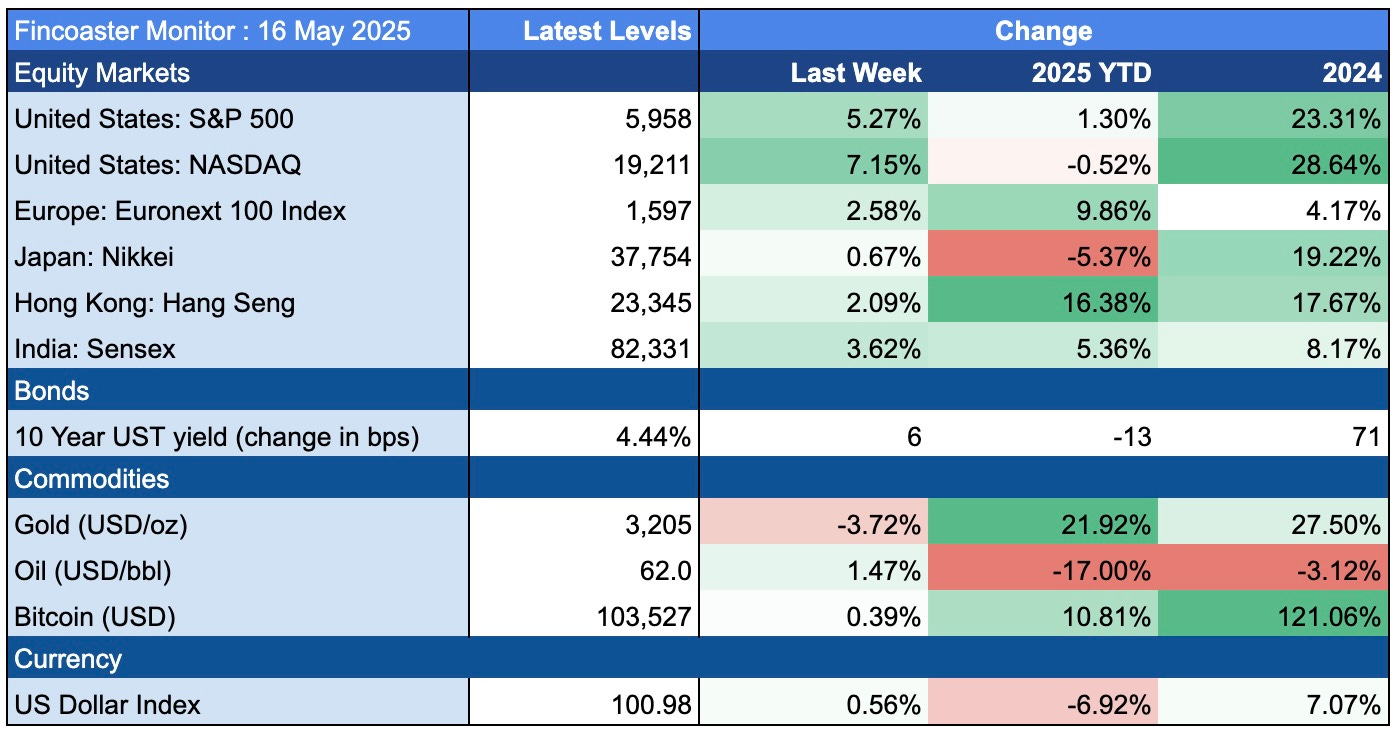

U.S. stock markets jumped this week, with the S&P 500 and NASDAQ climbing by 5.3% and 7.2%, respectively. Global equity markets also rallied.

A significant de-escalation in U.S.-China trade tensions spurred the positive sentiment. Both countries agreed to slash import tariffs for 90 days and established a framework for further talks.

Safe haven assets were weaker as investors adopted more positive views towards risk assets.

Gold declined by 3.7% but remains up strongly year-to-date. Meanwhile, 10-year U.S. Treasury bond yields rose by 6 basis points (0.06 percentage points) as investors reduced recession probabilities and expectations for rate cuts.

The U.S. dollar continued to recover and remains above the 100 level.

What Does it All Mean?

The series of improvements in global trade tensions since the 2nd April tariff announcements have led to a strong recovery in risk assets—the S&P 500 is now positive for the year.

However, uncertainties remain high, and valuations are now back to levels where investors should be cautious. Investors who are overexposed to equity markets may consider using the current relief rally as an opportunity to rebalance their portfolios.

What to look out for next week

After the markets closed for the week, Moody's said it downgraded the U.S. sovereign credit rating to Aa1 from Aaa.

Moody's already had a negative outlook on the rating, so the move isn't a total surprise. Further, it brings the rating in line with that of Fitch and S&P.

Moody's cited the deterioration in the U.S.'s fiscal metrics including large budget deficits and growing stock of federal debt.

Key ETFS declined in post-market action, and bond yields climbed further, indicating the likelihood of some volatility next week.

Chart of the Week

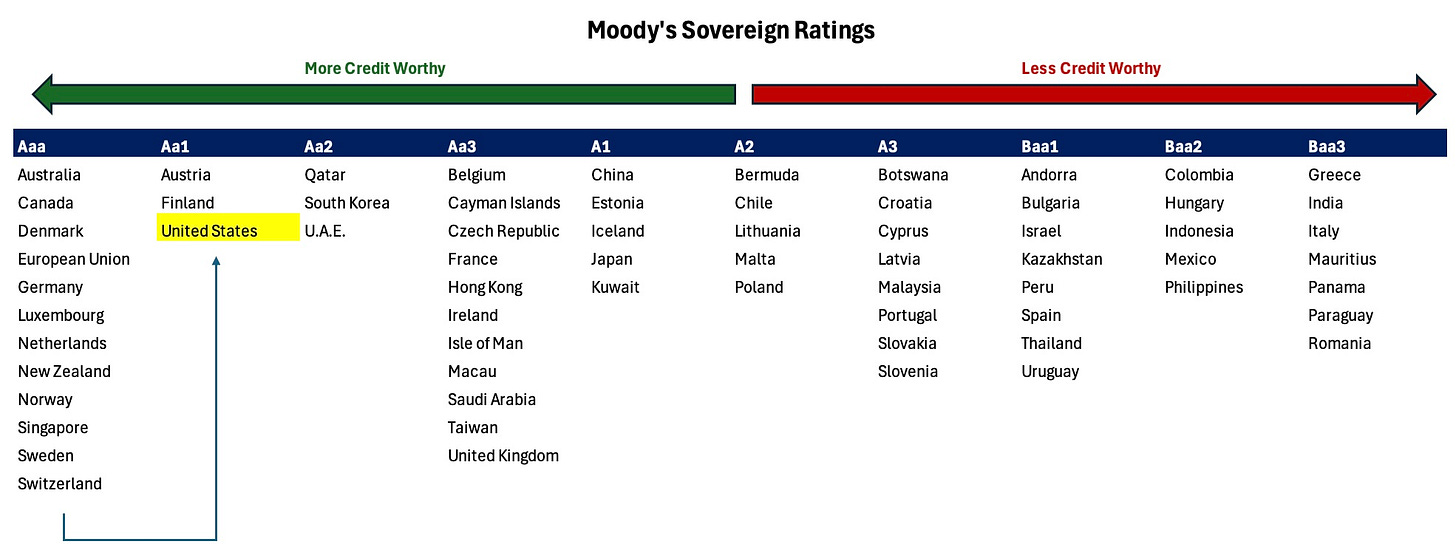

The below chart shows Moody's current sovereign credit ratings for investment-grade rated countries.

Investment grade ratings range from Aaa (strongest) to Baa3 (weakest). Below this are the sub-investment grade ratings (Ba1 and below).

The United States rating downgrade is shown—despite the downgrade, the United States remains amongst the most creditworthy sovereigns.

Thank you for reading. Please share the newsletter with those who may benefit.

Suvir Mukhi | Fincoaster.com

Disclaimer:

All content, information and opinions provided on Fincoaster are for informational and educational purposes only. Nothing contained herein is investment advice or recommendations. No guarantee is provided about the accuracy or completeness of the information provided. Readers should consult their financial advisers to ascertain the suitability of any investment.

Contributors to Fincoaster may, from time to time, have positions in any investments discussed.

Fincoaster is operated and managed by Envision Ventures Limited.